When Car Leases Offer Options For Less Than Zero

Back out the option premium from a car lease

Car leases are said to be “an option to buy”. Put-call parity is the most important concept to understand about financial options. At the core it really means a call or put can be turned into a straddle. An “option to buy” or call is also an option to sell.

I’ve talked about this a couple times in the past, most recently in Car Straddles. We usually lease our cars. We’ve bought some out and other times we’ve put the car back to the dealer after the lease term. If you are certain you want to own the car for long time, you should just buy it. You typically pay a premium for the option. It’s explained in that other post and in a prior one, Are Car Leases Confusing?.

We won nicely on our last Highlander lease we exercised the option to buy when used car prices were nuclear in early 2022. The used ones were trading higher than the new ones because the new ones were scarce/back-ordered. We exercised the option by trading the old one at a much higher price than the residual back to the dealer for the single Highlander on the lot. It happened to be the spec we wanted and the same boring ass white as our old one. This is called being lucky to have poor taste.

The questionable taste continues today. It looks like we are going to pick up a Hyundai IONIQ 6. I bring this up because the lease pricing is especially interesting for the next 2 weeks. My BIL, knowing we were interested in getting an EV, sent me this Slickdeals promotion:

This probably explains why I’ve been seeing a bunch of IONIQ 6’s on the road very recently in my area.

We did a family test drive of both the IONIQ 5 and 6 yesterday. It was high-fives all around — the wife and kids approved. Way more fun than the Highlander.

But let’s talk money.

The promotion is indeed real. The dealers are doing $10,000 rebate promotions. $7,500 comes from the EV tax credit — I thought there were income limitations on these yet the dealer claims there isn’t a limitation. He didn’t strike me as a reliable witness but regardless there’s actually a loophole where they are allowed to pass them on through on leases.

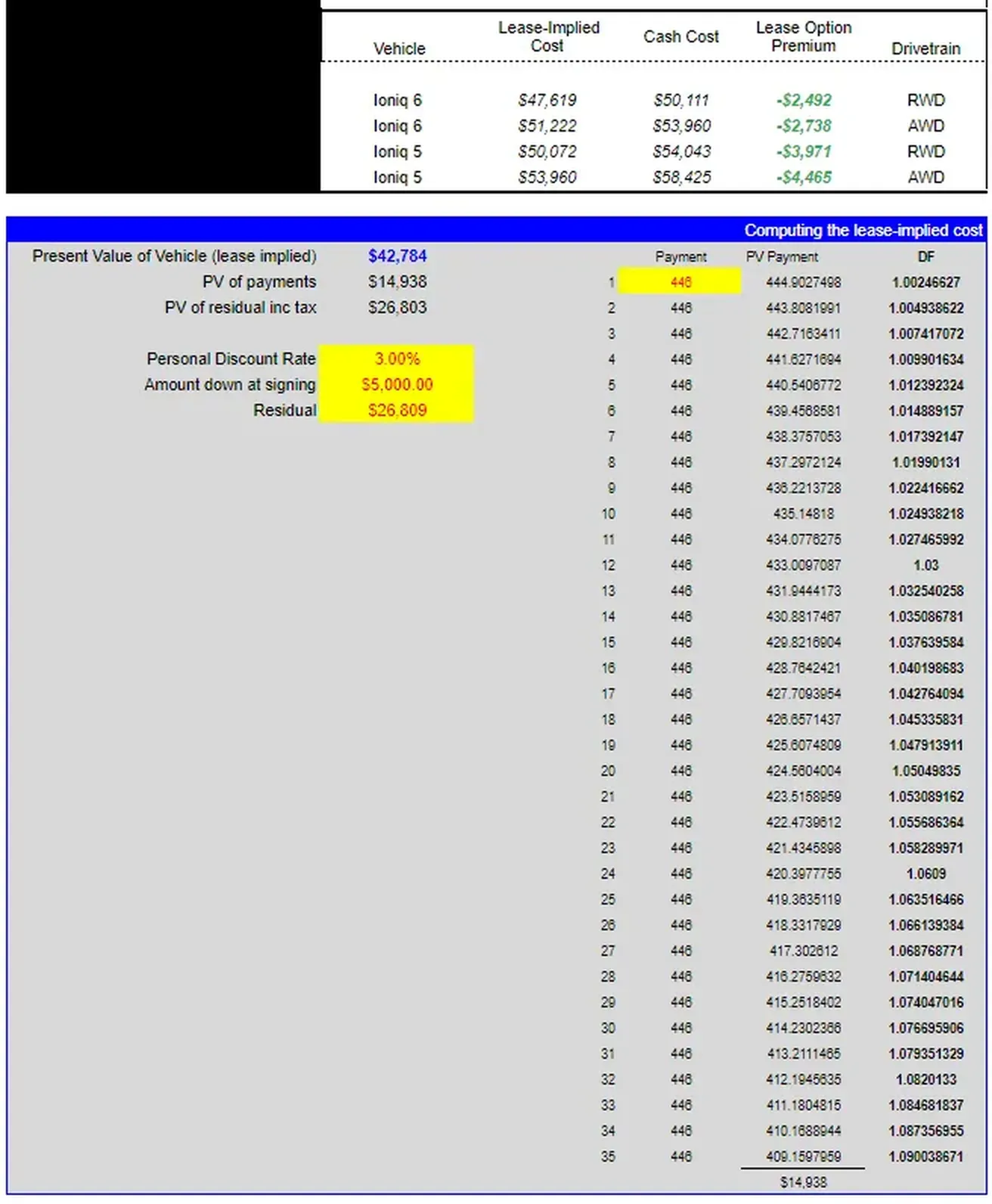

Being my tedious self, I needed to go home and play with spreadsheets. I wanted to compare how much it would cost to buy the car in cash (assuming an outright purchase is still entitled to the $10k rebate that occurs up front) vs leasing the car then buying it out for the residual in 3 years. My presumption is the lease method would lead to an overall higher cost because the option has value and I’ve seen this to be the case before.

Here’s what I compared:

- Purchase

This is straightforward…how much would it cost to buy the vehicle in cash including the 9.25% sales tax plus the scroll of fees. - Lease

The cost:

full amount due at signing (down payment and bunch of fees)

+the sum of payments over 36 months discounted to present value+

the residual (including tax) discounted to present valueI used an after-tax required return of 3% for the discounting. This is a conservative estimate. The higher the number you choose the more valuable the lease option and I’m trying to evaluate the lease conservatively.

Here’s the output:

Bizarre. Look at the “lease option premium” which I define as the lease-implied cost minus the cash cost.

You are effectively being paid to own the option. And if you can earn more than 3% after-tax on the cash you don’t spend up front, the lease is even better!

Unfortunately, I wasn’t able to check the pricing for other vehicles to see if this was just a Hyundai thing. The reason I couldn’t complete the exercise is it’s very difficult to find the “residual” amount in dealer lease quotes online. Without the residual, you can’t evaluate whether the lease payments are a good or bad value.

The online quotes are not thorough and more concerned with coaxing you into giving them your contact info rather than creating firm asking prices. I checked the websites for at least 15 car dealers in the Bay Area and the only ones that provided lease quotes with residuals were Toyota Walnut Creek and Hyundai of Dublin. Toyota leases were also more attractive than buying but Toyota is historically aggressive on lease pricing so it wasn’t extra informative.

Anyway, if you’re car shopping, I noticed there were a few brands in addition to Hyundai with steep discounts until June 3rd as extended Memorial Day sales.