Why You Don’t Get Paid For Diversifiable Risks

Examples of a counterintuitive aspect of portfolio theory

Finance theory dictates that an investor does not get paid for “diversifiable” risk. You do not get paid for idiosyncratic risk, only systematic risk. I have not formally studied the CAPM pricing model and prefer more intuitive explanations anyway. So I went to #fintwit:

What are the best explanations you know or links explaining why you do not get paid for taking diversifiable risk?

— Kris (@KrisAbdelmessih) April 29, 2020

Not looking for academic version. Looking for how you could explain it to a non-finance friend.

Twitter Roundup

You can click on the Tweet to see the responses. Here’s a roundup of the Tweets that most informed my understanding.

Here’s @Value_Quant:

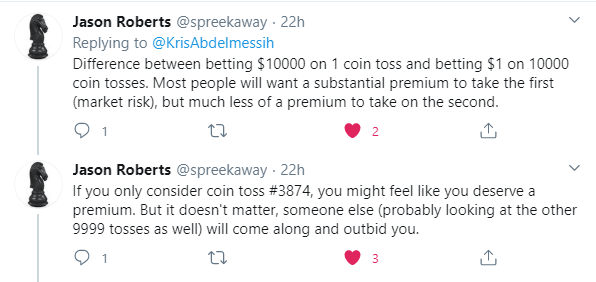

Here’s @spreekaway:

My Take

The responses helped me consolidate my own non-technical understanding. I’ll walk through my own take and how I’ve seen the idea that you do not get paid for diversifiable risks in practice.

A Bidding Game

First, a quick game derived from this Bogleheads thread:

Imagine there are 2 boxes. One of them holds 100k and one is empty.

You have a net worth of $50,000. Multiple people are allowed to bid and none of them has more than $50,000.

How much would you bid for each box?

This is an extremely risky bet. Perhaps you bid $40,000 for one of the boxes, for an implied 25% return (you are buying an asset worth $50k for $40k)?

In this narrow example, a box will trade for a healthy discount to its fair value but at the price that the least risk-averse investor is willing to pay.

What happens if everyone in the world is invited to bid?

Jeff Bezos will bid $99,999.99 to buy both boxes and have a guaranteed profit. Even if he were only allowed to bid on a single box, he would bid $49,999.99 since he still has positive expected value and the potential loss is an invisibly small percentage of his net worth.

This Is A Good Model For How Markets Actually Work

Think of how market-making firms profit.

- They are willing to trade for mere basis points of edge. Often it’s simply rebates.

- They make thousands of trades a day that get thrown into a giant pool of positions.

- The systematic risk or beta is hedged out so that they are left with a diversified, offsetting portfolio of idiosyncratic risks. Over time the law of large numbers crystallizes the expected edge into hard p/l dollars.

- This model validates the idea that providing liquidity is a long-term positive expectancy.

The business model rests on two concepts.

- Bet an appropriate fraction of the bankroll for a given amount of edge.

- Diversification

It’s just like the casino business. The house doesn’t care what happens on any individual bet as long as the bet is a small fraction of its bankroll.

Competition Drives Efficiency

Competitive equilibrium will mean that the casinos who can bid the highest for the “customer” is the house that can:

a) source the most uncorrelated offsets to the wager

and

b) has the biggest bankroll

In the trading business, condition A is satisfied by the market makers with the best data/analytics and “see the most flow”. A firm entrenched in both equity markets and futures markets with licenses from both the SEC and CFTC is going to be more efficient at laying off the risks it acquires from serving tourists regardless of the venue they choose to play in.

A and B will create a virtuous loop. The best players will build larger bankrolls which allow them to outbid competitors further which earns them first look at the flow which improves their models and so forth.

Note the role of bankroll and diversification in the following examples:

Banking

Banks are able to trade options outside the bid/ask when they do bi-lateral deals with energy companies. The resources they pour into doing custom deals and loans earns them the extra spread. They create a high touch VIP area with fatter margins. They do this by being horizontally integrated across credit and derivatives markets.¹

Bookmaking

Bookies are able to take the other side of Mayweather’s sports bets because they have offsetting flow (phrased differently: they can make 100% negative correlated bets). They can take their vig between many offsetting bets providing an ample cushion to justify sweating the residual position they cannot expect to hedge…the actual outcome of the game.

Life Insurance

By pooling risk, insurance companies can underwrite policies at an affordable premium that still leave room for an actuarial profit. If you, as an individual, wanted to write an insurance policy for your neighbor you would not be able to offer a price that was simultaneously affordable to your neighbor and compensated you enough to tolerate the risk of their premature death. And even if you had enough money to insure a hundred people, you’d need the infrastructure to source them from multiple geographies so as to minimize the correlation between the deaths in the event of a natural disaster, terrorist attack, localized pandemic, or asteroid.

Stock Investing

You are faced with 2 stocks with the following attributes.

The portfolio math to construct the chart is described in my earlier post.

Interesting things to note:

- Stock B is more volatile and a much worse risk/reward as proxied by its Sharpe ratio.

- At positive correlations, the optimal weighting is to load up on Stock A. Not surprising. In fact, the more of A you have, the better the portfolio Sharpe ratio is.

- But when correlations flip negative, optimal weights are now recommending significant weightings of Stock B.

- As I tinkered with combinations of assets I found that assets with low or even negative Sharpe ratios improve a portfolio if they are both negatively correlated and highly volatile.

The insight for me is that negative correlations make assets outstanding diversifiers even if they have negative expected returns. And if the asset has a negative correlation, high volatility can even be attractive.

This is one more reason to suspect that volatile assets can be justifiably overpriced and not a source of excess return premium. In fact, they are valuable despite their unattractive stand-alone attributes.

Summary

In an efficient market, prices setters:

- Are maximally-funded or have relatively low costs of capital

- Have broadest perspective/market access

The emergent properties of markets will lead to idiosyncratic risks being held by the player most optimized to hold it. If the risk is borne by the most efficient holder, it is by definition priced so that there is no portfolio to which the risk is more valuable. What remains are systematic risks that no entity has discovered a hedge for. Those are the premiums you are allowed to pick up.

When there is no diversification left to hide behind, the systematic risk can only be compensated by a pure risk premium. At the end of the day, there may be no hedge for getting 2 to 1 on a coin flip. The long-run is going to have to do.

Further reading:

Quant and author Aaron Brown explains on Quora (Link)

My brief post on market efficiency: Dinosaur Markets (Link)

Footnotes

- If you want to take this further you can imagine a scale player being able to bid above an asset’s fair value because they can make money in other ways. Such loss-leading strategies are common in businesses where firms have multiple lines of business and view customers holistically. For example, charging zero brokerage fees to attract more clients so you can sell them branded funds or capture additional net interest margin. This can even work in market-making. Banks may commit risk capital at prices that actually lose their trading desks money if it means building a more lucrative prime brokerage or lending arrangement with the client.