Why meme stock put spreads look expensive

How vol drag influences vertical spreads

I got words today tying back practically to Sunday’s Money Angle about the relationship of vol to stock distributions. It’s very relevant to anyone investing in publicly traded assets, which they, with a straight face, expect to double in the next year.

Why meme stock put spreads look expensive

[This is based on a chat I responded to but I won't doxx the stock.]

The stock is $20. The 1-year 20/10 put spread is $6.

The market is offering you odds on the proposition that this stock doesn't tank. Said otherwise... The market thinks the most likely scenario is the stock tanks.

If you think the stock is a coin flip this looks juicy. And the nice thing about vertical spreads is if you hold to expiry, they really act like a "model-free" bar bet. Like an over/under style bet. Their value depends only on the probability of the stock expiring in some range but not nearly as sensitive to magnitude like an outright option.

[That was a core lesson in this video]

Anyway, you look at this put spread and think it sounds really fat.

But the pricing makes sense for an extremely risky stock.

Why?

Because of vol drag.

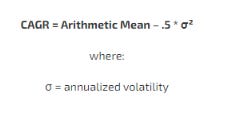

Remember this guy:

Think of it this way...suppose owning the stock has 150% annualized vol and owning offers a similar risk/reward as many other assets.

Say a .50 Sharpe (you can decide if this is generous).

Therefore, you estimate an annual return of 75%.

Option math rests on continuous compounding ie log returns.

So what's the median expected stock price in 1 year?

Really expensive put spreads go hand-in-hand with high volatility.

Whether that's an opportunity is up to you.

(This pricing is very common and smart, ie hard to beat, in commodity markets during short squeezes. I've covered this in cotton, silver, and this one in nat gas).

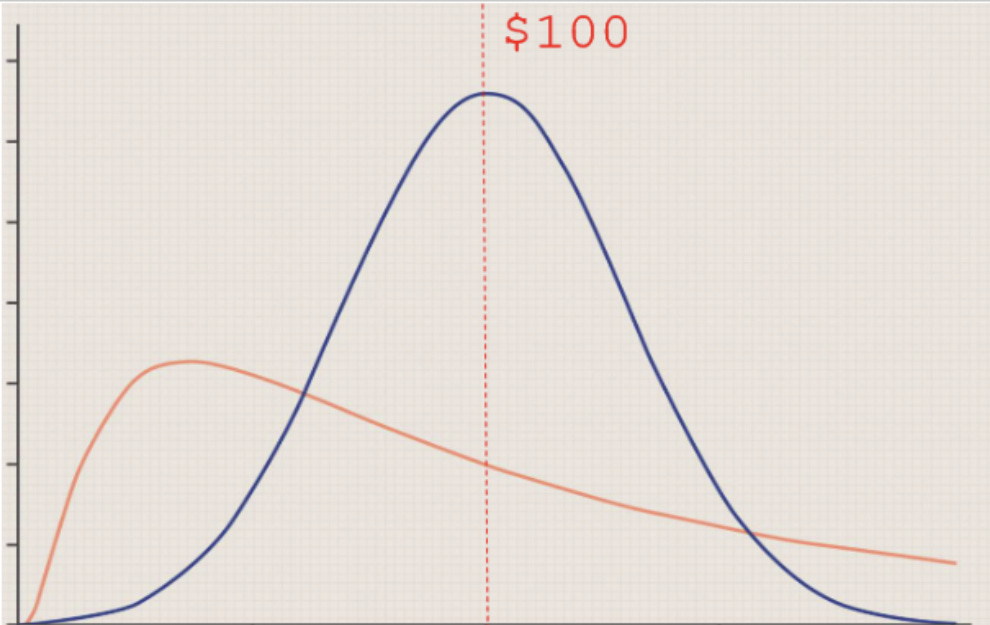

High vol names tend to be distributed like the orange not the blue.

Do you see how this all ties together? I'm explaining why the pricing might look like it does. You can say that the model is academic, so its discrepancy is an opportunity. Yet, the quotes you see don’t come from an ivory tower but a marketplace.

The option skew shifts in response to the buying and selling, adjusting theory for what the gamblers and sharps, anchored in the reality of betting to make money, think.*

It might be a coincidence that the pricing lines up pretty well with how vol influences return math or maybe these put spreads are expectancy on sitting on the sidewalk.

Either way there is a sound explanation for why those put spreads “look high with the naked eye”. Alas, the only way to credibly say "that's stupid" is to trade against it. TAFO.

*The more advanced audience knows skew is complicated because it's the moderator of a dialogue between "what's terminal value at expiry” and spot/vol correlation in the meantime. But that topic is yak shaving for most.