Weighting An Options Pair Trade

Theta vs vega weighting

An option trader pinged me about a trade between a correlated pair of names whose IV ratio was trading at an extreme level compared to the ratio of realized volatilities that the pair has experienced in the past.

This trader is experienced. He understood that pitting vanilla options against one another invites path dependence. It’s worth spelling that out with a demonstration:

Imagine both assets are trading for $100 so you buy the 100 strike straddle in asset A and short the 100 strike straddle in asset B. Once these assets start bouncing around the moneyness of the straddle positions will get out of sync. After a week if both assets realize the same volatility but the path of A means it’s up 5% and the path of B means its up only 2% then you will have more gamma and theta in B because the straddle is closer to at-the-money (ATM). The further you get from a strike the more your exposure “goes away”. Far OTM options spit off smaller greeks and are less sensitive to changes in underlying price or volatility.

Let’s get to the question.

He was theta-weighting the trade instead of vega-weighting the trade. He wanted to know if I would do the same.

I’ll give examples of how each approach will end up weighting the legs, how I’d weight the trade, how to map weightings to the nature of a relationship, and even what greeks depend on.

By the time you finish this post, you will be able to understand the risks of different weightings and how to compute weightings in your head knowing nothing else except spot prices and ATM vols.

Let’s start with definitions.

Delta

Change in option price for a $1 change in the stock price

If an option has a .50 delta and the stock increases by $1, the option value increases by $.50

If it was a put option the delta would be negative. If the option has a -.50 delta and the stock increases by $1, the option falls by $.50. If the stock had fallen by $1 then the option increases in value by $.50

Vega

Change in option price for a 1 point change in the implied volatility

If an option has .20 of vega than a 1 point increase in implied vol, for example from 15% to 16%, the value of the option increases by $.20

If implied volatility fell from 15% to 14%, the option loses $.20

Gamma

The change in the delta for a $1 change in the stock price

If an option has .05 gamma and .50 delta and the option goes $1 more in-the-money then the option delta increases from .50 to .55. The option is becoming more sensitive to the stock price. As an option goes far in-the-money its delta continues to increase because of gamma until it approaches 1.00. At that point the option is so far in-the-money it moves 1-to-1 with the stock price.

If our .50 delta option with .05 gamma falls $1 out-of-the money its delta falls to .45. It becomes less sensitive to the stock price on the subsequent move. If the option continues to fall further out-of-the-money, its delta will fall to zero and changes in the stock price will have no impact on the option value. It is so far out-of-the-money it’s likely worthless.

Theta

The amount an option price decays when 1 day elapses

A key observation which harkens back to the path-dependance demonstration:

Greeks, ie option sensitivities, are a single snapshot in time.

They change if any of the inputs change — volatility, time to expiry, interest rates/divs, or moneyness (ie the distance of the stock price from the strike price).

This is important because when we place a pair trade (long one option and short another on different names) we initialize it by trying to do it in a vega or theta neutral way. We aren’t trying to make a statement about the general implied vol, but the relationship of the implied vols to one another.

Getting back to the reader’s question…do we initialize neutrality with vega or theta?

The answer depends on what you are trying to capture when you bet on the relationship of the implied vols.

What is it about the relationship that you are trying to make a statement about?

- Do you believe the implied vols should trade at a certain spread to each other?For example, stock A’s implied volatility is typically 5 points higher than stock B, but they are both trading for the same volatility so you want to buy a straddle on A and short a straddle on B. How do you weight that trade?

- Do you believe the implied vols should trade at a certain ratio to each other?For example, you believe stock A should trade at a 50% higher volatility then stock B. If both are trading for 10% volatility, you want to buy straddles on A and short straddles on B. How do you size those trades?

There can be a world of difference between a spread vs ratio relationship.

If stock A is 20% volatility and stock B is 10% volatility the ratio is 2 and spread is 10 points.

If both volatilities double then the ratio is constant but the spread is now 20 points!

If you weighted the trade to bet on the ratio your p/l is 0. If you weighted the trade assuming the spread would stay fixed, your pair trade is now spitting off a bunch of p/l.

The easiest way to build intuition for this is a toy example.

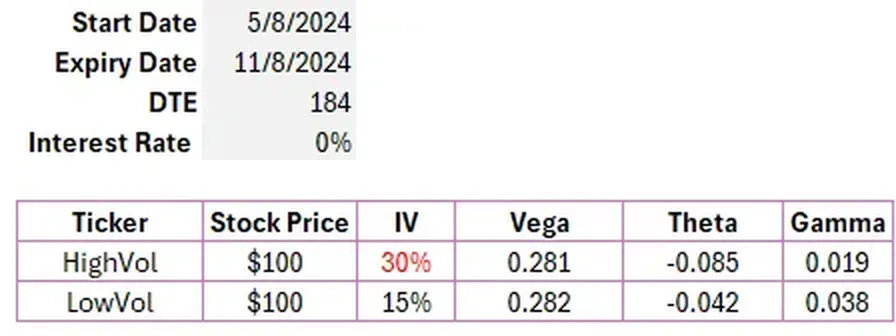

Consider 2 stocks, HighVol and LowVol. They are both $100 and we are going to initiate a pair trade in a 6-month options.

I used an option calculator to compute the greeks for the 2 names:

Observations

- Regardless of the volatility, the options on each name have the same vega.

- HighVol options, which are twice the volatility of LowVol, have twice the theta and half the gamma.Intuition:theta: An option that has 2x the volatility, all else equal, is worth 2x the premium of the lower vol option. It has 2x the amount of theta to decay to zero.gamma: A $1 move is twice as significant to LowVol than HighVol. Just like a 1% move in SPY is more meaningful than a 1% move in TSLA.

Higher implied vols mean bigger thetas and smaller gammas

P/L under both weighting schemes if volatility doubles

Vega-weighting

If you vega-weight the pair trade you will trade the same amount of options in each name. Why?

If you short 100 contracts of HighVol your net vega will be -2810.

-100 x .281 x 100 share multiplier

If you buy 100 contracts of LowVol your net vega will be +2820

+100 x .282 x 100 share multiplier

Net vega = -2810 + 2820 = 10 which rounds to zero. If the vol in both names goes up by 1 point you make $10 which is 1/10 of a penny on 100 option contracts. Less than the commission. Mark it zero.

We’ll just round the vega positions to long and short 2800 for the 2 legs of the trade.

What happens when vol doubles?

Notice that vega per option doesn’t really change. Computing the p/l is straight forward.

Your long option position in LowVol increased by 15 vol points (15% to 30%).

P/L on long options = 15 points x 2800 = $42,000

P/L on short options = 30 points x -2800 = -$84,000

Total p/l for pairs trade = -$42,000

If you vega-weight a trade, you are exposed to the spread! The ratio stayed the same but you experienced p/l. This weighting was not a bet on the ratio!

Theta-weighting

Let’s buy LowVol and short HighVol again but this time weight the legs by theta. Remember, LowVol has half the theta as HighVol so to be theta-neutral we must buy 2x as many options in LowVol.

Let’s buy 200 options in LowVol vs shorting 100 option in HighVol.

We are theta-neutral, but what’s our net vega?

Vega in LowVol = 200 contracts x .28 x 100 multiplier = 5,600 vega

Vega in HighVol = 100 contracts x -.28 x 100 multiplier = -2,800 vega

Net vega = +2,800

A theta-neutral weighting means we are long vol.

Once again let’s shock the vol but keep the ratio constant.

If LowVol goes from 15% to 30% we make 15 vol points x 5,600 = $84,000

This perfectly offsets the $84,000 loss we’ll experience when we ride a short 2,800 vega position in HighVol up 30 points as vol doubles form 30% to 60%.

Theta weighting neutralizes our position to the ratio, but it is exposed to the spread!

Consolidating what we know

If we balance thetas:

- our positions will have a net vega

- we are hedged against the ratio of the vols but not the spread

If we balance vegas:

- our positions will have a net theta

- we are hedged against the spread but not the ratio of the vols

How would I weight an option pair trade?

I generally look at trades as ratios. Why?

Because they are not level-dependent.

If the absolute level of vol is in a tight range then the spread will be stable. For example if you trade WTI crude options against Brent crude the vols are similar. If you buy 5,000 vega in WTI at 29 vol and hedge by shorting 5,000 vega in Brent at 30 vol you are vega-weighting the pair. And that will suffice for small changes in volatility. The ratio will move around a bit, but for the most part the vol spread will be pretty fixed and you’re roughly hedged so long as that’s true.

But over wide changes in volatility, the ratio is more likely to hold. If there are 2 names that are 10% and 20% vol respectively and vol roofs, I don’t expect that we’ll find these names trading at a 10 point spread like 60% vs 70%.

They won’t be trading 60% and 120% to keep the ratio constant either. But there will be less error in assuming that then vega-weighting as if the spread will stay constant.

Once a grenade goes off, path dependence is likely to swamp much of the error around the edges as you will see your vegas grow and shrink as the spot moves closer or further from your strikes as realized vol starts interacting with the implied vols.

Neither weighting is a panacea for “Am I fully hedged?”

You should look at the history of a relationship to see if the ratio or spread appears to govern the bungee cord between the 2 names but my default is theta-weighting which implies more trust in the ratio.

Just remember:

- if you are betting on the ratio, use theta-weighting

- if you are betting on the spread, use vega-weighting

The vega of ATM options

Holding DTE constant, we saw that gamma and theta depend on the vol level.

You may also have noticed that vega didn’t.

The 15%, 30%, and 60% vol options all had about the same vega. That reality is why we used an equal weight for the legs of the trade when we vega-weighted.

So what does vega depend on?

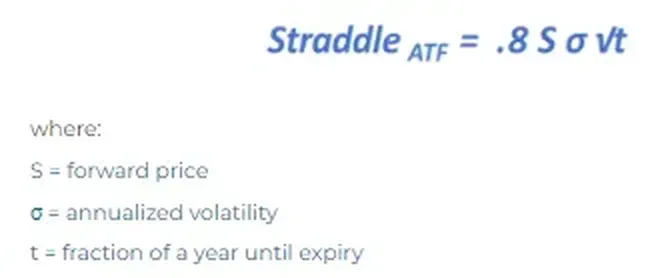

This is neat — ATM vega depends only on the spot price and DTE. We are holding DTE constant.

[Note: When I use ATM here I’m technically referring to ATF or at-the-forward but I’ll just say ATM which is more familiar to most]

So ATM vega only depends on the spot price. If you double the spot price you double the vega.

The proof of this can be seen easily from the approximation of the ATF straddle:

If I re-write that, it’s clear:

Straddle = σ x (.8 * S * √t)

Remember vega is change in option price per 1 point change in volatility.

A 1 point increase in σ changes the straddle by .8 * S * √t

Ignoring time ‘til expiry, the ATM vega is strictly a function of spot price!

If we vega-weight a pairs trade and Stock A is half the price of Stock B you will need to buy 2x as many options on A. In the examples we did above, both stocks were the same price.

Final recap

Holding DTE constant:

- ATM vega depend only on spot price. Even if a pair has different vols, to vega weight a pairs trade simply weight by the ratio of the prices. This is a bet on the vol spread.

- Thetas are proportional to vol levels. To theta weight a trade, weight by the ratio of the vols. This is a bet on vol ratio.

Learn more

- Visual Derivation of Straddle Approximation

- Finding Vol Convexity (Although ATM option vega doesn’t depend on vol level OTM option vegas do!)

- Colin Bennett on Weighting Pair Trades

- Colin Bennett on Weighting Dispersion Trades

- Moontower on Gamma & Gamma Weighting

- Moontower On Time-Weighting Vega Risk

- From Financial Hacking: To dollar-weight or share-weight a dislocation in a highly correlated pair?