vol speed round

recent action

I’ve been trading more than usual this week. I sent a couple impromptu emails describing my thinking.

Sunday: a quick thought before the week

Monday: moontower raw: things i did today and why

Tuesday: moontower raw: another day of trading

I updated you on all my thoughts but the main thesis that drove my positioning:

There was pressure building for either other countries or Trump to step up. The longer the impasse lingers the more damage it does to the global economy and even if you don’t think the economic damage is mutually assured destruction, a chunk of the population who helped give Trump a plurality was, well, nervous is probably an understatement. It’s hard to get Elon to shut up and he was relatively crickets if he wasn’t posting Thomas Sowell free trade memes.

Regardless, it was likely that a headline would come pretty soon.

Then the erroneous Walter Bloomberg tweet that spiked the SPX 7% gave a tell on what a major trade deal announcement could mean for the straddle.

Translating this into option surface language:

There’s going to be a big up move soon. But if not, the market leaks lower. Spot VIX remains north of 40 even though we didn’t move Monday. Or Tuesday on a close-to-close basis.

In short…this market looks like an earnings stock in which there a large lump of variance that needs to be priced. We just don’t know the earnings date.

My positioning of choice:

- Buy buy OTM calls and call spreads instead of buying the dip. Don’t hedge the delta.

- Buy May VIX futures

What’s the thinking?

- If the announcement doesn’t come the market goes lower. All I’ve done is incinerated call premium. But the VIX futures “decay” higher towards spot. They roll up. My shadow decay in the VIX futures helps defrays my call option decay.

- The ratios are tricky (more on this below).

- I’m looking at where stocks have come from to anticipate what price level they could rip to (and their betas to SPY on the move).

- I need to guess the up and downside of the May VIX futures. This helps me estimate their beta to SPY. If SPY is up 10% how much are the futures down…I figured probably not worse than 25% given how flat the VIX futures curves was for 2025 once you got past the front 2 months. In other words, regardless of what happens, the market thinks vol is here to stay. 3-9 month term structures are surprisingly firm at these elevated levels. (I also looked up rolling 1 month vol for SPX and noticed that it barely dropped below 20% in 2022…Given how discounted they looked to spot VIX and the volatile context of 2025 already…i thought 5 clicks was a reasonable downside for those futures, but they could probably go up 10 points if the market dropped another 15% (a down beta also of about 2.5).

I’ll prattle off some trading thoughts and lessons from the experience behind the paywall but just 2 things before that.

1) Remember, SPOT VIX IS NOT TRADEABLE!

When vol spikes, people go “number is up I should sell, it always goes back down”.

That’s not expectancy thinking. The VIX futures were at a significant discount to spot VIX. Spot VIX can fall, but it doesn’t mean your short futures will profit. The discount could simply narrow. Vol will likely go down, but that’s baked into the fact that you would need to sell VIX futures 20 points below spot. It’s like buying puts in super hard-to-borrow name…the point spread already implies the stock much lower. You sold me May futures and I just explained my reasoning above for why they seemed cheap. If you’re adamant to buy a dip just buy stocks. Your trade expression is strongly correlated to doing that anyway. Why the brain damage and the vig without understanding the the true nature of the trade?

See Benn’s tweet for more

2) The app is shining in this environment. Without this lens, I wouldn’t be able to “see” what sticks out without our opinionated metrics.

Speed round…

VIX Complex

Remember Path, VIX, & Hit Rates vs Expectancy: ways to price VIX and what we can learn from it?

It explains that when VIX basis blows out option traders “arb” the relationship by buying single or SPX options, selling the futures and selling VIX options.

But if implied correlation also explodes, then dispersion traders need to sell index vol and buy the single stock vols. In the VIX basis algebra, we can deduce that the edgiest thing to do is skip buying the SPX options and skip right to buying the single stock vols. You can imagine that single stock option liquidity is the limiting reagent on the whole entire arb complex. Especially single stock tail puts (correlation has a skew as well, downside corrs have a massive premium to implied upside corrs).

Feelings I shared in the subscriber Discord

If the market heads lower, a VIX futures squeeze will likely be the most stretched trade on the board. It may even trade better than the classic "buy-the-dip" play. But that’s only relevant if you can weather the margin pressure.

A possible redux of the trade ideas from @Euan and @Andrew Mack’s book:

Sell VIX futures to buy strangles on QQQ or similar index options.

I’ve written before how VIX futures replication resembles a vanilla strip of options (minus the optionality on VIX itself). This isn’t necessarily something one should do — it’s more about recognizing the structural relationship between VIX futures and plain vanilla index options.

Hero trade

At some point — if a VIX squeeze really gets going — I’ll likely sell VIX futures outright instead of buying stocks. My current allocation is about:

- 50–55% T-bills

- ~20% equities

- The rest in bonds and alts with varying betas

But let me be clear:

That move only comes when it feels like the world is ending — when liquidity is terrible and markets go “end of the world wide.”

I was on a trading desk during COVID, and you could feel when reasonable prices leave the building. No economic actor wants to cross a 5–10% bid/ask spread. At that point, only forced sellers trade.

Will that happen again? I don’t know. But you should be prepared.

Bitcoin, USD, and Vol Regimes

This setup feels bullish for BTC.

Even more interesting: BTC vols aren’t that high, especially considering the macro setup. I’m watching for a chance to buy a slug of upside calls — not outright delta.

Why?

If we see selling of USD and Treasuries, that cash is going somewhere. That dynamic is bearish for USD hegemony, and crypto may be a recipient.

“Earnings” but the date is unknown

Recall the setup I described earlier. My premise was:

the market is going to have a face-ripping headline soon because of mounting pressure; if else, market goes lower, vol is nuclear

It’s good to get out the calculator and play with event sizes. If anything just to get a sense for these crazy term structures might imply.

I’m not a quant running a dispersion book, back of the envelopes is fine. We’re traders in a fast market. We get a few data points:

- Let’s say the face-ripping rally is well-estimated by the Walter Bloomberg 7% market tell.

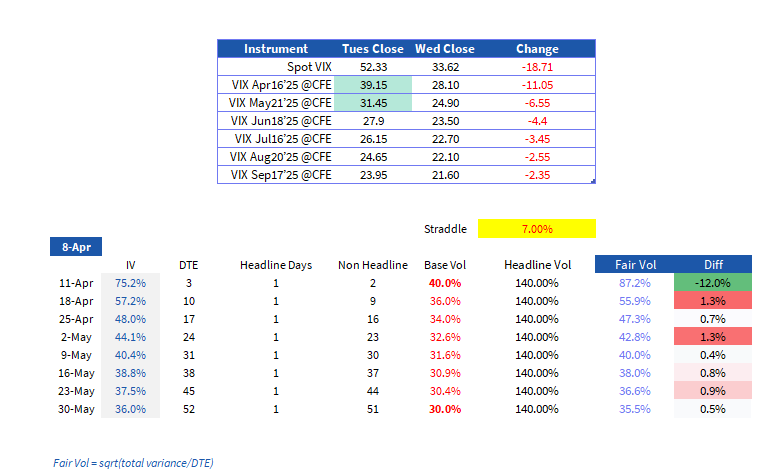

- Pull up the VIX futures and the SPY ATM vols.

- Assume 1 headline day this week (hence encompassed in every expiry)

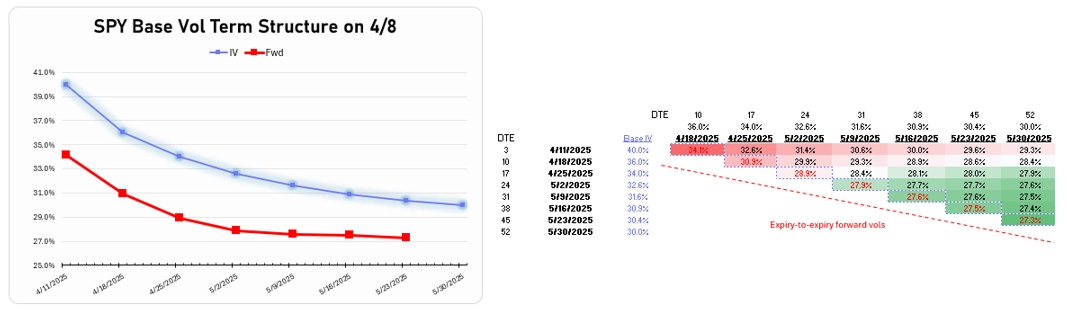

- Handicap a reasonable “base” or non-event vol term structure. I started with 40 vol corresponding to the April VIX future settling next week, descending to 30 vol or a 25% discount by late May. This roughly mirrors the VIX futures backwardation rate.

- Remember that a straddle to be converted to a vol needs to be annualized then multiplied by 1.25 (This is all explained in how an option trader extracts earnings from a vol term structure)

Here’s the calculation with these assumptions:

You can see that with these assumptions, April 11th looks cheap, all the other months are a touch high but given the vol levels, that feels like noise. It makes sense that April 11th is cheap if we assume a 7% move this week!

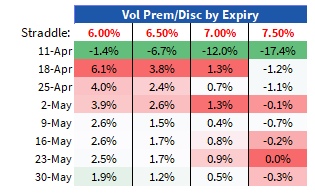

What if we use other straddle assumptions:

In hindsight, the vols were cheap…IF you think those base vols are reasonable estimates for how we’ll move. What does that base vol term structure look like and what forwards doe sit imply? I came up with the base vol curve from 40% down to 30% by fitting to a orderly forward curve.

So if you thought a 7% straddle is fair, then you can isolate your opinion on whether a forward vol curve that descends into the mid 20s seems cheap or expensive. Notice how quickly, that seemingly insanely “high vol” starts to resemble very reasonable assumptions once you learn how to extract.

💡When is “earnings”?

Notice that if you moved the “headline” from this week to next, this week would have flipped to very expensive and next week very cheap. A proper option desk is likely imputing the probability of the “headline” being this week or some other week. If we give a substantial weight to this week, and a some weight to next week I think the surface would be even better fit. But this gets into many degrees of modeling — why not model multiple headline days? I left out the non-Friday expiries but we could try to fit through them as well. I point this out to open your mind, not to make you think that this is how crazy option traders are getting with this stuff (some are but they probably speak French if not Russian).

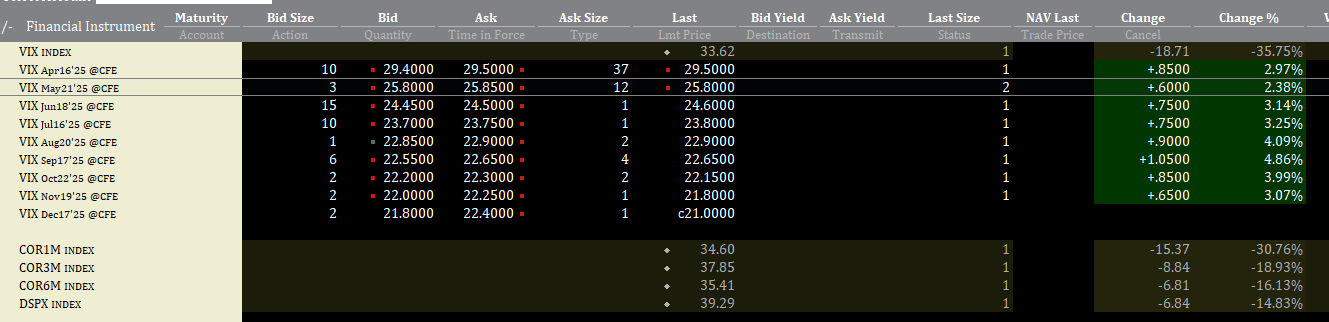

📷If interested this is what my VIX tab looks like in IB

Reflecting on how I did now that the headline happened

The short answer is I made some money on all the trading but it could have been much better. I’ll rip thru a bunch of observations.

1) My most concentrated call longs were in NKE. Despite rallying 10% I only tripled my money on the calls. 10% sounds like a lot but the calls were targeting more like 17%. 10% was barely more than SPY’s rally. NIKE underperformed on the whole sell-off, then underperformed again on the rally leaving it even more forlorn.

I was looking for it to hit rip into that gap on the headline, hopefully I panicked oversold vibes. But live by vibes, die by vibes.

It didn’t get there so I sold the deltas and rolled it into ES, I have no interest in extra idiosyncratic risk now that the “event” I was playing for is over.

2) The May VIX futures held up according to the beta I expected. I trimmed most of them now that the game is over. There’s more to say. On Tuesday night I was sitting pretty as the futures rallied strong after the close and into the evening. Twitter was insanely bearish. I put scales out to sell some of the futures.

Today, after it’s all done, had I gotten filled on a portion of them, it would have been a really nice week instead of small gain. In other words, my sizing was more defensive than I thought. The difference between an ok outcome and good one was just few contracts.

If I would have won nicely on a down move, won small on a 10% up move in SPY and would have won more if the rally was sharper in NKE my assessment of the position was correct…a small up move was my worst-case, but I thought unlikely. Overall the position had some equity in it to use gambler language. Like you bought an underdog, they rallied in value, you now have a free shot on the outcome, and then of course they lose. Womp womp.

This is what neutral-type of trading feels like. Trying to create good risk reward. But this is America. You’re supposed to just buy the dip. And then say you knew your guy would come through for you.

I’d be remiss to not remind you…if you are trading equity options you should be using moontower.ai. The cost is small, like a dime on a 100 lots. Per year.