VIX futures vs VIX synthetic futures

law of one price in action

Here’s an FYI that reinforces a lot of moontower 2025 writing on option synthetic futures.

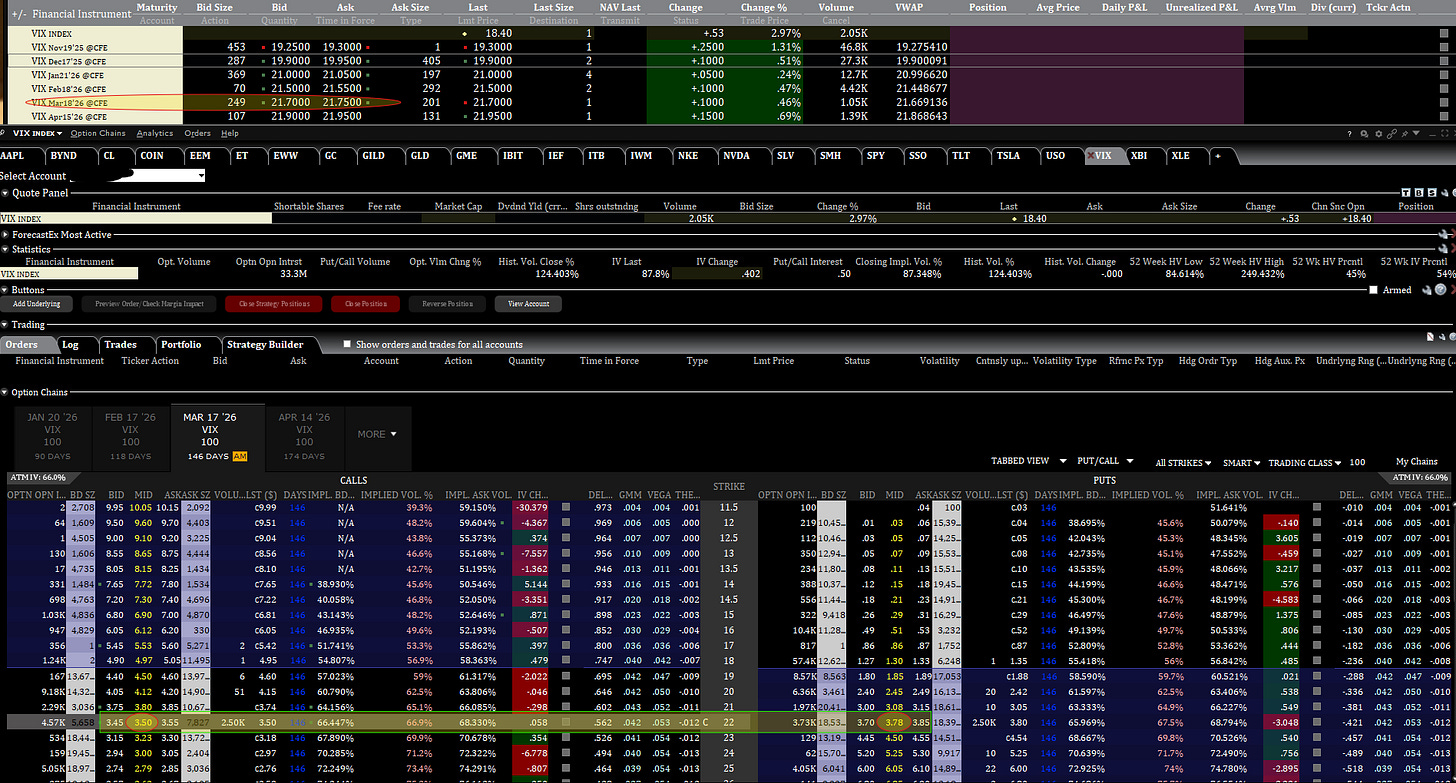

This is from my IBKR screens from 10/22:

Spot VIX was 18.4

I highlighted the March VIX future. It had a mid-market of 21.725

The ATM strike for options on VIX expiring in March is 22.

The combo or price of the 22 synthetic =

call price - put price = 3.50 - 3.78 = -.28

Synthetic future = Strike + Combo = 22 -.28 = 21.72

No arbitrage available folks (as expected).

The synthetic future on VIX and the actual VIX futures trade in line.

💡The VIX options and futures typically expire on the Wednesday morning preceding monthly option expiry cycles. The options cannot be traded between the prior night's close and the Wednesday settlment but the futures can.