Using The Right Rulers

My notes on 2 books about measurement

Just popping in to share my notes on 2 books. The links go to my notes.

More Than A Numbers Game: A Brief History of Accounting by Thomas King

Advanced Portfolio Management by Giuseppe A. Paleologo

I picked up these books because of an interest in the practice of “measuring correctly”. Context always governs what “correct” means.

A quote by Paleologo the opens Chapter 8: Understand your performance

The Earth rotates around the Sun at a speed of 67,000mph. When I go out for my occasional run, my own speed is in the tens of thousands of miles per hour Should I take credit for this amazing performance? I wouldn’t be completely lying if I bragged about this with friends (which I do); but it would be more transparent if I mentioned that my speed record is in the frame reference of the Sun. In this frame of reference, my speed is indistinguishable from Usain Bolt’s. This factoid obscures the vast difference in skill between the two of us. To really understand the difference, we need to change the frame of reference. Another way to interpret the decomposition of returns is a method to change the frame of reference in investing. Total returns — and a portfolio’s total PnL — live in the Sun’s frame of reference. It is easy to fool ourselves with the belief that we beat birds, airplanes and supermen at their own game. Idiosyncratic returns and PnL live in the Earth’s frame of reference. If we want to compare our performance to that of our peers, or to our very own past performance, we need to move to this frame. Factor-based performance attribution makes it possible.

Paleologo’s book is short and technical but flows quickly (the heavy lifting is shoved to the appendix). I’ve heard that this book was standard issue for fundamental PMs in Citadel pods but this is unconfirmed. Also unconfirmed — industry folk were pissed at Paleologo publishing this. It is a conceptual manual for how pods manage risk to isolate “idio”.

Your instruments should measure what matters for your strategy. Warren Buffet doesn’t care about 1-month realized volatility any more than a flow trader should care about AAPL margins. Your dashboards should be windows into your actions. The select group of tools in your pencil box must survive ruthless interrogation. Someone spouts some data point and your response should be “Thanks for the cocktail trivia but does that even matter?”

The Paleologo book is catered towards professional investors so you can just go to my notes if that’s you. More Than A Numbers Game will have wider appeal.

Moontower readers will especially enjoy the options section in chapter 12.

Favorite Bits from More Than A Numbers Game

Chapter 2: Railroads

- Perhaps the most important accounting decision a bookkeeper can make is determining whether resources consumed today will generate revenue in future accounting periods. If the answer is yes, then the charge should be capitalized and classified on the balance sheet as an asset. If not, then the balance should be expensed, flow through the income statement, and accumulate as a reduction in retained earnings. This issue will reappear in subsequent chapters.

- During this time, financial accounting began to serve a third purpose. In the most cited journal article in the history of finance, “Theory of the Firm,” Michael Jensen and William Meckling showed the interests of employee-managers and outside investors could never be completely aligned. Agency costs represent investor losses sustained when employees act in unwanted ways. Absentee ownership became synonymous with corporate America. Dispersed ownership means no individual shareholder can influence management actions, especially when management controls the proxy process for soliciting shareholder votes. Management abuses can easily arise from the institutional separation of management from ownership.

Chapter 3: Taxes

- Three tenets of US tax policy have been:

- Ability to pay

- Equality of sacrifice

- Imposition of burdens commensurate with government benefits received

- A corporation is a legal being. Where a partnership is a conduit to its owners, a corporation is an entity distinct from shareholders with its own records. Corporations, legislators reasoned, were fully capable of paying their own income taxes.

- In 1913, Wyoming became the 36th and last state needed to ratify the 16th amendment to the Constitution. Congress then had the power to collect taxes on income without regard to apportionment or consensus considerations.

- A fundamental dissonance: financial accounting’s primary goal is to provide useful information to management, shareholders, creditors. Tax accounting rules, by contrast, permit the IRS to collect revenue. Financial accounting should be conservative with measurement error deliberately biased in the direction of understatement of income and assets. Tax accounting in contrast should protect the public treasury and improve the amount and timing of collections. The dissonance of tax and financial accounting objectives makes attempts to reconcile the two impossible.

Chapter 4: Costs

- Every control system brings unintended consequences. People react to incentives in ways not contemplated by the system’s designers. Engineers use the term suboptimization to describe the mindless pursuit of one goal to the detriment of a broader organizational interest. In 1992, a famous article “The Balanced Scorecard”, by Harvard Business School Professor Robert Kaplan and Massachusetts consultant David Norton, sought to address this problem. The authors likened the management information system to an airplane cockpit’s instrument cluster. Pilots need a holistic view of operating performance to keep the plane flying as intended, and a well-defined control system reduces critical variables to a handful of measures that can be understood by all.

Chapter 5: Disclosure

- Through the 1934 act that created the SEC, Congress granted it the authority to prescribe financial accounting principles and specify the form and content of financial statements. In one word, the SEC is about disclosure. The SEC also sought to narrow the diversity of accounting practices. The SEC gave itself the power to approve financial statements instead of just requiring their disclosure. Perhaps the best-known part of the 1934 Act was prohibiting company officers from buying or selling their employer’s securities while in possession of material non-public information.

Chapter 6: Standards

- [Kris: This chapter is concerned with efforts to make accounting approaches uniform for easier comparison, highlighting the tensions of who accounting rules serve. There is always discretion and debate, and short-term winners and losers, even if the cash flow should be unaffected in the long term.]

Chapter 7: Science

- An implication of the EMH and related statistical research was that financial accounting standards do not matter. Investors in aggregate review all sorts of accounting and non-accounting data to divine company prospects. As shown with the LIFO controversy, there is considerable evidence that investors see through accounting form. Well-functioning capital markets may not need strict conformance with clearly articulated financial accounting rules. If investors were indeed slaves to accounting income, a few bright analysts could earn enormous trading profits after making adjustments for cosmetic accounting standards. No one has yet found a way to do this.

- However, the EMH may not be sufficient to discipline these managers if they hold incorrect beliefs about investor behavior : “Sorry, I understand cash flow trumps accounting earnings, but those naive investors do not. I’ll make accounting choices that give them earnings trajectories they think they want.”

Chapter 8: Inflation

- The issue of inflation accounting is the first instance where academics were able to apply science to resolve a financial accounting debate. This chapter serves as a case study of what could happen if academics and practitioners communicate more effectively.

- Tactically, the inflation accounting experiment failed. Users did not find restated balances relevant or reliable. In addition, LIFO inventory accounting provided only a partial solution because inventory costs remaining on the balance sheet became increasingly out of date.

- Strategically, the debate shows that academics could help statement preparers resolve a financial accounting dispute.

Chapter 9: Volatility

- The second seminal event in the history of corporate finance was the development of the capital asset pricing model. However, financial statement preparers paid little attention to this groundbreaking concept. Consequently, corporate management did not overcome an ill-conceived fear of reporting volatile earnings.

- While working at the RAND Corporation, William Sharpe met Economist Harry Markowitz. Markowitz’s famous 1952 paper, “Portfolio Selection,” showed that diversification reduces risk. However, Markowitz struggled to pinpoint how the correlation among returns of individual holdings influences aggregate portfolio risk.

- The required return, also known as the cost of equity, represents expected earnings needed to attract equity capital for a particular investment. This forward-looking measure depends on investor sentiment and cannot be observed directly.

- Sharpe published the Capital Asset Pricing Model in 1964. Sharpe, Markowitz, and Merton Miller shared a Nobel Prize in 1990 for laying the foundation of modern financial economics. Sharpe argued that the investment risk of a given stock is not about raw volatility. Investors face risks that can and cannot be eliminated through diversification. Buyers of financial instruments demand to be compensated for systematic risk resulting from swings in economic activity. They are less concerned with idiosyncratic risk.

- A major hurricane could cause substantial damage to homes in Miami. A local property insurer faces ruin. Financial markets will not punish this firm with exorbitant equity costs. Potential investors can diversify by holding shares in a lumber company that would see sales rise in the event of a major windstorm. The presence or absence of a hurricane would little influence combined returns of both securities.

- Problems with reporting volatility have caused tension between standard setters and statement preparers since the 1930s. Managers believe investors consider bumpy earnings a blemish when evaluating a firm’s earnings power; by contrast, standard setters want companies to tell it like it is, alerting outsiders to the presence of warts on a corporate earnings trajectory.

- Three case studies illustrate this tension:

- Currency translation

- Accounting for the value of defined benefit pensions which depend on interest rates and are long-duration liabilities

- The valuation of financial securities held in corporate portfolios

Chapter 10: Intangibles

- By 2000, intangible resources came to be recognized as the only significant corporate asset class worth acquiring. Most receivables, inventory, machinery, and land can be replaced easily.

- In 2002, Microsoft’s total recorded intangible assets represented just less than 1% of the company’s market value but the accounting problem with intangible assets is not relevance but reliability.

- In 1944, CAP distinguished:

Purchased intangibles from those developed internally

Those with finite lives (patents and licenses) from those with indefinite lives (goodwill and perpetual franchises).

There was no guidance for valuing internally developed intangibles.

- In 1974, the FASB put forth the most concise standard in US GAAP: All research and development costs encompassed by this statement shall be charged to expense when incurred.

- In 1985, the FASB decided to expense all R&D but then established an exception for software development.

- Spring loading? (the case of IBM buying Lotus 1 2 3) — Taking a large one-time charge that helps a firm show subsequent earnings growth after new management comes to power.

- In 2001, standard setters once again did not address accounting for internally developed intangibles. The focus was on intangibles acquired through purchase or merger. Instead of concluding that all intangibles are wasting assets with finite lives, the new standard concluded that goodwill and other intangibles have indefinite lives and should not be amortized arbitrarily. They should be tested for impairment at least annually, and any identified impairment should be charged to income.

- To this day, standard setters have not determined how to value internally developed intangible assets other than software.

- Case of AOL

AOL spent heavily to grow a subscriber base quickly. Publicly traded firms needing more financing feel enormous pressure to report consistent profits. Bill Sharpe’s arguments about diversifiable risk mean little to aspiring corporate treasures.

AOL capitalized acquisition costs on the balance sheet and amortized them over 24 months. If AOL had expensed them, it would have reported losses. Literally, accountants would shy away from capitalizing intangible asset development costs because it is hard to match these costs with uncertain future revenues.

AOL grew through a series of remarkably bold acquisitions. Its soaring stock price created a currency to buy significant companies. When it eventually bought Time Warner, one critic described it as “one company without assets buying another one without a clue”. Nearly 2/3s of AOL’s assets were goodwill.

(AOL would eventually agree to a $3.5 million fine to restate 1995 and 1996 earnings.) - In 2002, Corporate America paid the price for its 1990s acquisitions binge. It recognized $140 billion of intangible write-offs, a sum equal to the write-offs of the prior eight years.

Chapter 11: Debt

- Practitioners showed little interest in the efficient markets hypothesis. As a consequence, many statement preparers believed that outside creditors and investors could be fooled by the optics of financial statement presentation. The form of a balance sheet could seemingly trump economic substance when analysts evaluated a company’s health. This belief manifested itself most clearly in accounting for debt on the balance sheet. The presence of debt came to be viewed as a sign of corporate weakness. Management teams pushed standard setters to permit companies to keep debt off the balance sheet presentation.

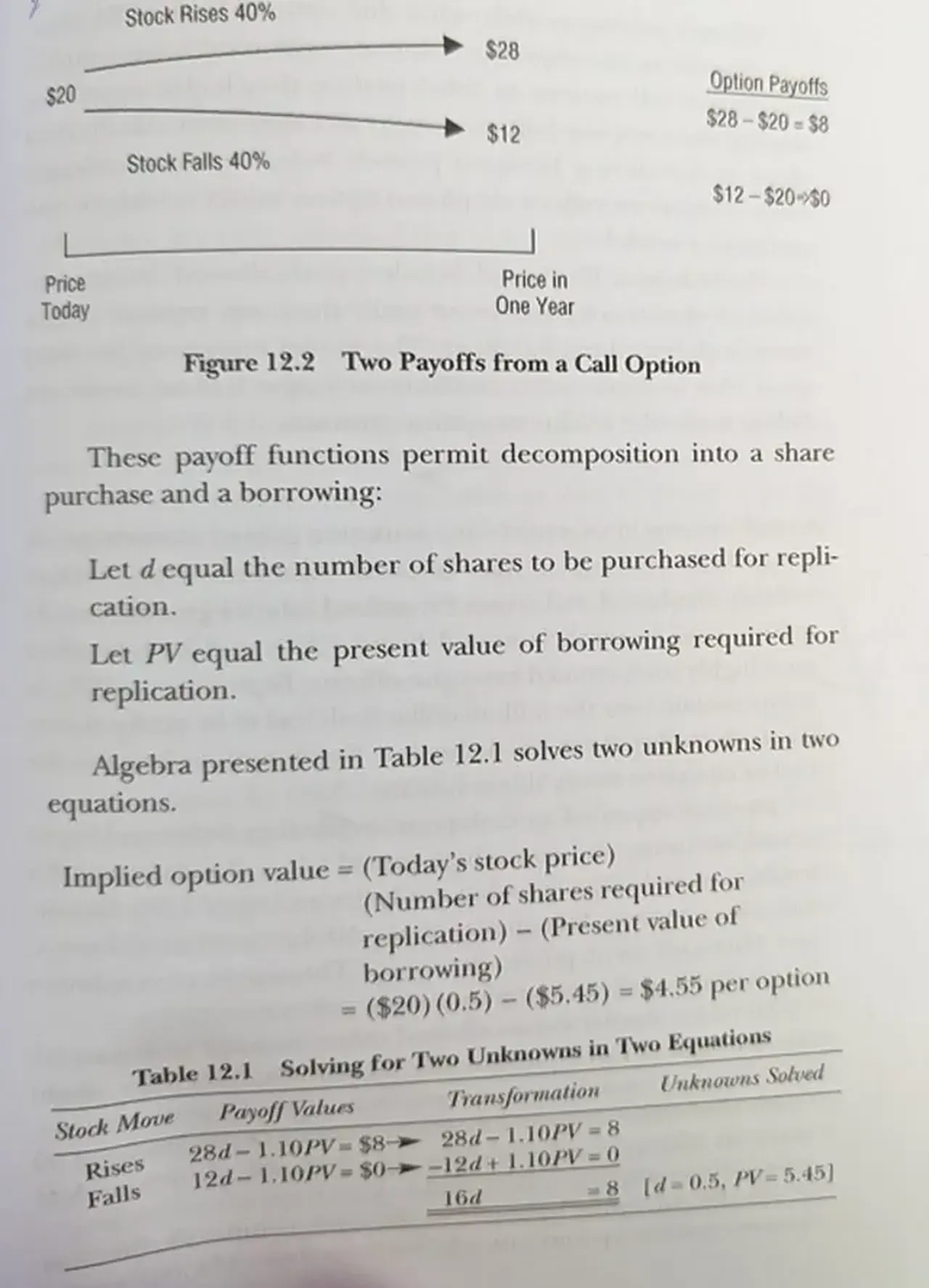

Chapter 12: Options

- The third significant idea in the history of finance was the development of the Black-Scholes option pricing model. This chapter describes how compensation with options replaced debt as a governance tool in the 1990s.

- The Black-Scholes model allowed accountants to resolve a long-standing debate, yet practitioners remained slow to embrace this tool. Corporations did not charge option-based compensation expenses to income statements. Financial accounting thus enabled some corporate boards to make outlandish use of this compensation tool.

- Academics spent decades trying to solve the problem of option valuation.

- In 1933, two Columbia professors stated that option contracts had not been traded long enough to permit the formation of any intelligent judgment of their value.

- A legal scholar in 1953, concerned with the decline in real purchasing power for executives from 1939 to 1951, thought stock options would be a tax-efficient means of restoring executive pay, but he was concerned there was no realistic method of arriving at a dollar value for an option.

- An accounting theorist in 1970 acknowledged there was no definitive way to value options. Even Paul Samuelson and Robert Merton could not find a general solution.

- Accounting bodies had wrestled with option valuation since the 1940s, especially within the context of compensation.

- The use of options in executive compensation gained momentum after a 1993 revision to the IRS code, which disallowed deductions for annual salaries greater than $1 million paid to CEOs of publicly traded firms and its four other most highly compensated executive officers. Beginning in 1994, any compensation over the million-dollar limit had to be performance-based to qualify for a tax deduction. Stock options became the tool of choice to satisfy this condition.

- From 1985 to 1997, stock option awards increased tenfold. From 1970, CEO pay averaged 39 times an average worker’s salary, increasing to 1,000 times by 1999.

- In 1993, the FASB concluded that options have measurable extrinsic value, which should be charged to expense over an appropriate vesting period. The following year, 3,000 people met at the San Jose Convention Center to protest the proposal. Stock option accounting became so divisive that it threatened the board’s future working relationship with some of its constituents. While the board stated unequivocally that options have a value that can be estimated by option pricing models, it only required that firms disclose proforma earnings as if they had used the option models.

- The FASB allowed the disclosure alternative to bring closure to the debate, not because it believed that the solution was the best way to improve financial reporting. Arthur Levitt admitted that urging the FASB to back off from its proposal to expense options was the “biggest mistake I made as SEC chairman.”

- By December 2004, the FASB required companies to value option grants with pricing models and charge this sum to earnings over appropriate service periods.

- The case study of options accounting shows management’s continued preoccupation with reported earnings and disdain for economic research. Unfavorable financial disclosures came before awards, which a senate could argue depress stock prices and increase the number of options granted for a given dollar value of variable compensation. Good news was disclosed after awards to prevent a run-up in the stock price and reduction in the number of options granted for a fixed dollar award.

- When offered academic evidence at an FASB hearing that the stock market shrugs off accounting adjustments, the Home Depot chairman snapped, “You’re trying to confuse me with logic here, it’s not going to work. I deal with the emotional side of the street. I deal with Wall Street.” No amount of science could convince this manager that financial markets are reasonably efficient.

- Research confirmed academic intuition. There was no significant consequence of expensing options on company stock prices. The results were consistent with the University of Chicago studies that markets see through accounting window dressing when valuing securities.

In the spring of 1973, the CBOE opened for business and the May-June issue of the Journal of Political Economy published the “Pricing of Options and Corporate Liabilities” by economists Fisher Black and Myron Scholes, who resorted to stochastic calculus and physics heat transfer equation to solve the problem.

Chapter 13: Earnings

- Previous chapters showed that statement preparers did not pay much attention to the Efficient Markets Hypothesis, Capital Asset Pricing Model, and Black Scholes option evaluation model. Therefore, some management teams believe that:

1) Investors could be fooled by financial statement presentation.

2) Reporting volatile earnings was a sign of weakness.

3) Option awards had little cost.

Consequently, it is not surprising that management at many companies became obsessed with using accounting tools to meet quarterly targets to boost stock prices and inflate the value of option awards. - The ultimate measure of corporate success in the 1990s was producing a long, consistent earnings trajectory. Rational managers, trying to impress outside observers, routinely met or beat consensus numbers by a small amount. Earnings coming in well above a threshold would simply cause outsiders to raise the bar further.

- Of course, all businesses mature. None can grow faster in perpetuity than the US economy; otherwise, that firm becomes the US economy. Corporations that choose to smooth earnings can get into trouble towards the end of the business life cycle. Management must come up with increasingly heroic assumptions to meet ever higher earnings targets extrapolated from a linear trend.

- The tone changed in the 1990s with the success of blue-chip firms such as General Electric. By 1998, SEC chairman Arthur Levitt bemoaned that accounting had become a “numbers game” where management suppressed common sense business practices, satisfied consensus earnings estimates, and projected a smooth earnings path in an attempt to grow a company’s stock and the value of their underlying options.

- The EPS bubble burst when accounting scandals came to light at the turn of the millennium. What seems to have been occurring was a game in which analysts and investors were testing the quality of a company’s stated earnings by determining whether management could hit its targets. This odd game of inferences created the strange market phenomenon in which companies that missed their earnings by a penny or two saw 20 to 30% declines in their share prices. Reported earnings became important because management actions made them so important!

- A parallel story to the EPS drama was the rise of pro forma earnings. Technology firms in the 1990s issued press releases featuring pro forma earnings figures in addition to earnings prepared under GAAP. Telecom companies’ enormous infrastructure investments saddled earnings with large depreciation charges. Management chose to focus investor attention on earnings before interest, taxes, depreciation, and amortization. Warren Buffett poked fun at this practice of EBITDA.

- However, researchers compared stock prices and earnings data for companies that did and did not report pro forma numbers. They found little difference in stock price behavior. In other words, investors did not appear to price shares of firms issuing pro forma earnings differently from those disclosing only GAAP numbers.

Epilogue

The four dialects of US accounting:

- Financial accounting offers outside investors information about the likelihood of debt repayment and future dividends.

- Tax accounting allows the IRS to compute its share of corporate income.

- Cost accounting helps management control operations.

- Statutory accounting lets regulators monitor capital adequacy.

- Discretion invited trouble.

- We learned that the act of observation disturbed the subject. The more importance users attach to accounting figures, the less comfort users can take in their reliability.

- Research related to EMH suggested investors eventually see through gimmicks when setting security prices. They do not necessarily punish raw earnings volatility, and acceptance of option pricing models may have led to expensing of grants and more intelligent use of this incentive tool.

- Today’s financial accounting issues will continue into the future. The resources spent to create a conceptual framework will likely show little benefit. Accounting will remain a pragmatic tool full of idiosyncrasies. Well-crafted principles will not solve these problems either, based on studies of pooled interests, leases, and lost contingencies.

- And finally, no control system can ever guard completely against bad management behavior. The only workable solution is for corporations to select CEOs with impeccable integrity.