the arbitrage reflex is more profitable than the opinion reflex

the "system 2" reaction to a proposition

A traditional way to think of a stock price is the expected value of its future prices weighted by their probability and discounted to the present. Ignoring the cost of money, in a binary world a $100 stock could be fairly priced if it was 50/50 to be worth $200 or $0. It is also fairly priced if there’s a 20% chance of it going to $500 and an 80% chance of $0.

There’s this vocal VC named Keith Rabois who aggressively cheerleads his companies. I don’t know the guy. His online persona exudes many standard deviations of F-U confidence. Sounds par for the uber-rich these days, but he’s extra fun because he’s pugnacious. And got baited into a silly pride bet.

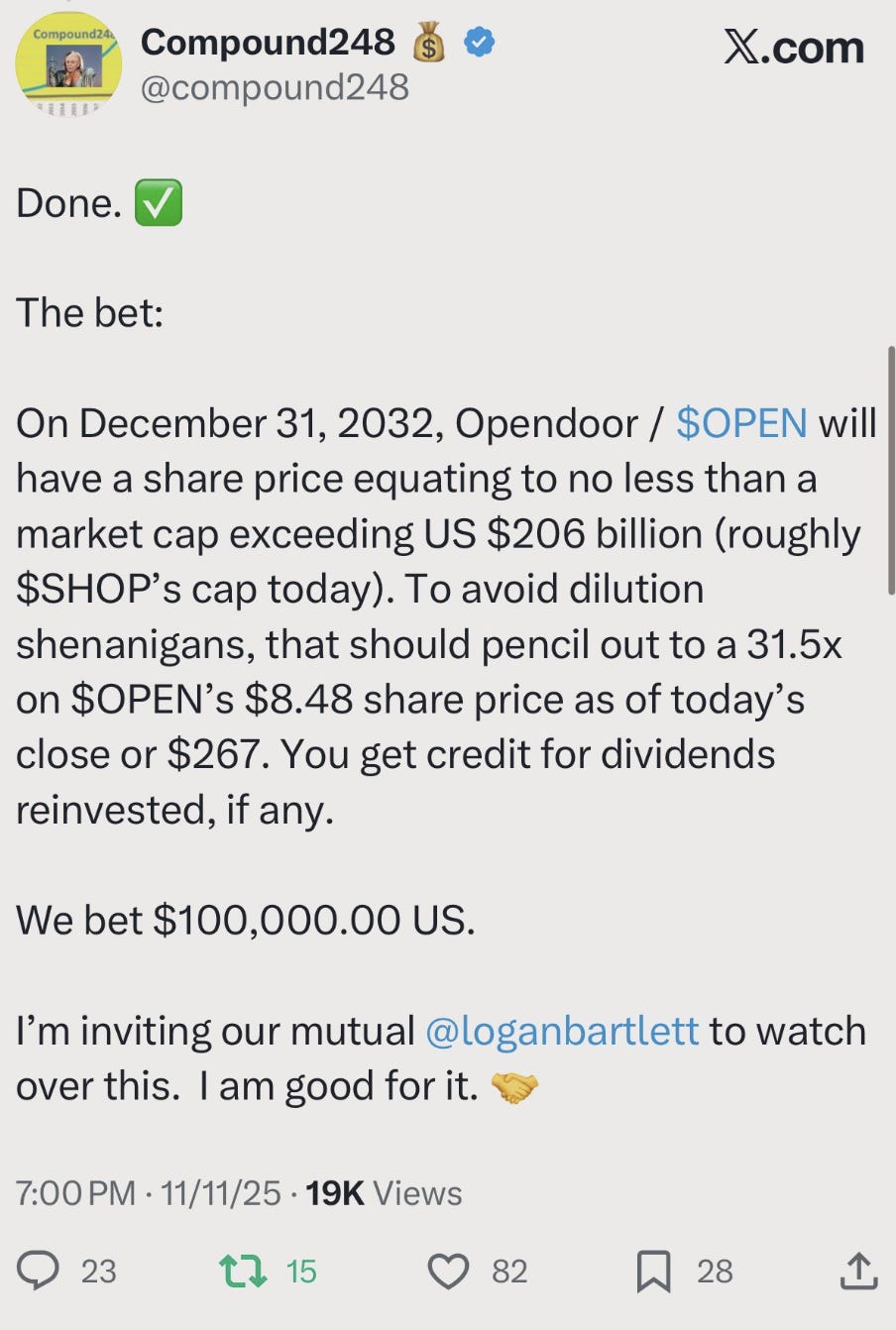

Here’s a tweet from investor @compound248:

We wouldn’t talk about this in the Masochists section because this is fairly basic financial reasoning. The type that really needs to obvious to everyone in a society is flirting with a simulcrum of the movie Rat Race. But it’s appropriate to spell out the opportunity here in gambling terms.

Keith is offering an even-money bet, his $100k to Compound248’s $100k on the stock multiplying by 31.5

If you think in odds:

Keith is offering even money on a 30.5-1 odds proposition

That might be more clear when you think of Keith buying the stock. If he buys $OPEN he risks losing the stock price or 1 bet and if the stock goes up 31.5x he wins 30.5 (because the 1 bet or amount of cash he spent for the stock is not part of his win or return).

It’s similar to how a stock 2x’ing is 100% return, or 10x’ing is a 900% return. A stock that 10x’s paid 9-1. You risked S, you won 9S if S is the stock price.

Normally when you buy a stock, you get paid dollar for dollar as it moves times the number of shares you have. If the stock doubles you make S in profits which is how much you risked when you bought it. You are paid in proportion to the move.

Keith needs a heroic move to simply get paid even money. His proposition is an arbitrageable violation of how return works. I don’t know anything about Compound248’s outlook on $OPEN by him taking the bet. He could be bullish or bearish. When you hear the proposition, your mind shouldn’t go to “Is $OPEN a good or bad investment?” because what you should do doesn’t depend on this assessment.

Keith’s offer is free money regardless of your outlook.

He’s laying 30.5-1 odds where the max loss is $100k.

So you solve for “How much OPEN do I need to buy to make a $100k profit if it pays 30.5-1?”

It’s simply:

1/odds * bet size

1/30.5 * $100k = $3,280.21

I need to buy $3,280.21 worth of shares. Since the stock was $8.48 that’s just about 387 shares.

If the stock goes to 0, you lose the $3,280.21, but Keith hopefully pays $100k. If the stock does go up 31.5x, you break even.

You could also structure the hedge so that at a stock price of 0, you break even. You buy $100,000/$8.48 or about 11,792 shares. If the stock hits Keith’s bogey you get paid 30.5 on your $100k and you happily peel off 1 bet size to him as a tip. Any share quantity you buy between 387 and 11,792 is a guaranteed win.

An amusing post-script to this story is HF manager Benn Eifert requesting $10mm of action on this proposition. Of course, Keith said no — he’s confident not stupid. Keith said he did the bet with Compound248 just to shut the “troll” up or something.

I don’t understand how rewarding a troll with the easiest money I’ve ever seen is anything but encouraging future trolls, but maybe this is why Keith is rich and I’m writing on the weekend.