stop with the stop-loss debate

on stop-losses

Certain topics re-infect popular social media discourse like an engineered cold virus. Like when the NY Times is having a slow week and drops the “Couple Can’t Make Ends Meet in NYC on $500k a Year”

This is not a fresh take. Sorry to be crass, but NYC is a beacon for dreamers around the world who want to partake in a life tournament. It is entirely indifferent to your needs.

Plus, $500k is not what it was. Also not news.

[The number of millionaires in the US has doubled twice in 20 years. For the investment-brains Rule of 72’ing that in their heads, it’s 7% growth in millionaires per year.

Also when you break out their expenses, it always includes “private school”, “max 401k contribution”, and a parade of “needs” that insult normal people’s definition of “ends meeting”. The headline should say “I make $500k and don’t feel rich”. And for that our nice couple that got As in school should be banished with their expectations to either 1992 or literally any place that is NOT the final table at the Main Event. Sorry, but aliens only need apply. ]

The fintwit version of “discourse that doesn’t die even though everything we know about the situation is evergreen” is whether one should use a stop-loss.

I’ve watched this conversation come and go so many times. I can no longer restrain the impulse to do that thing that nuisance colleagues do in meetings... raise my hand to hear my own voice.

[You know as soon as that hand goes up you’re just “omg please kill me what set of life decisions brought me to this moment in the universe where I have to hear this pick-me baby perform this routine in a conference room in front of a weary audience of which 2 are muted on a zoom call with their camera off in their car on the way to Starbucks for the will to finish Wednesday” ]

With that pep rally…

let’s talk stop-losses

First, the obvious:

A stop-loss is a risk management tool, not an alpha tool.

The purpose and effect are to change the shape of your P&L so you can endure.

The cost of a stop-loss, aside from slippage and transaction fees, is sometimes cutting eventual winners.

Euan Sinclair gives this a proper treatment with math.*

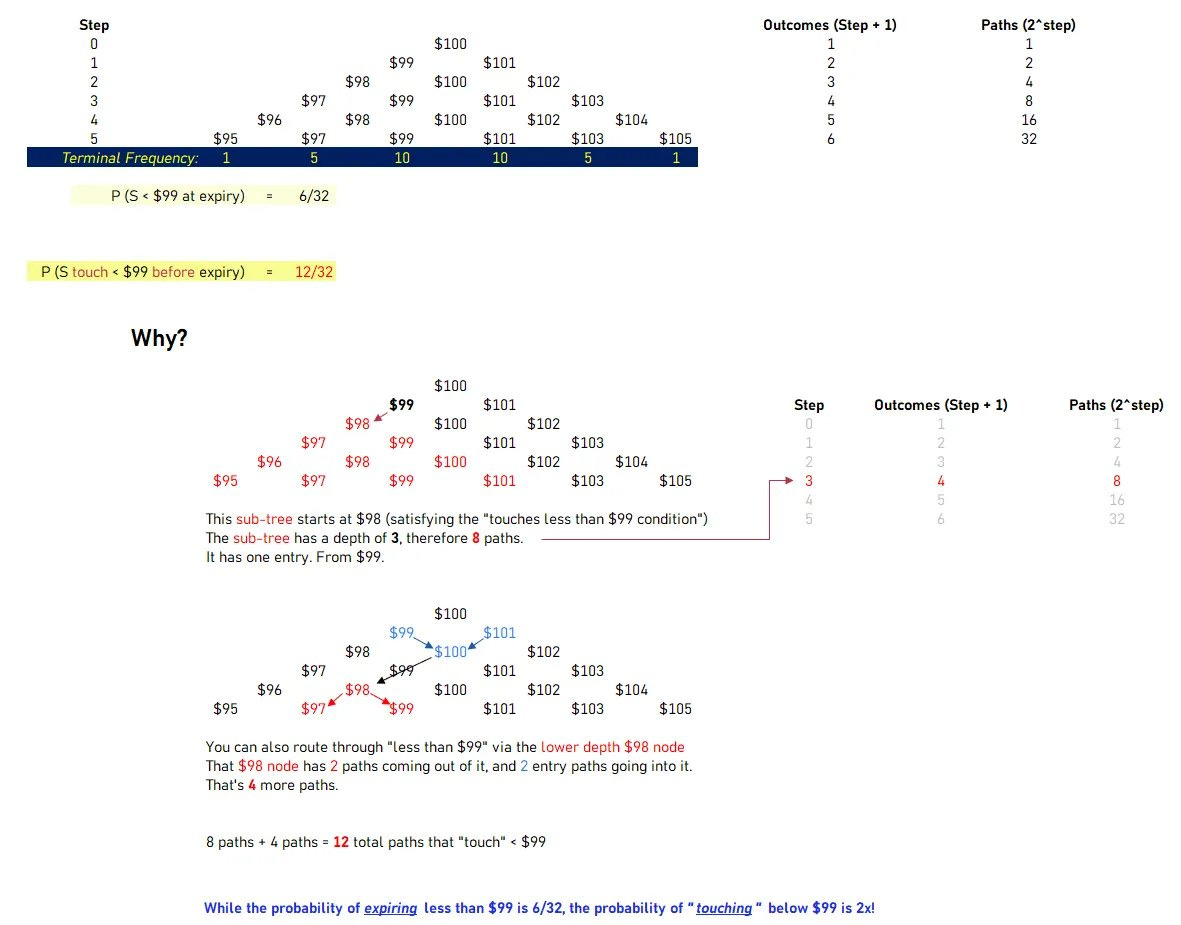

The tribal intuition is closely related to the idea behind a one-touch option.

Remember this from Sunday?

You can also analogize to options trading.

Gamma hedging is not an edge. It’s a hedge. It reduces position size. It’s a cost.

[See a misconception about harvesting volatility]

Stop-losses, like gamma hedging, are a kind of passive flow — they’re independent of signal and discernment.

They’re forced in the sense that the time of trade chooses you, not the other way around.

If you chose the time because you thought you had an edge, you'd evaluate it based on alpha criteria. But since it’s risk management, you benchmark it against other ways to manage risk — like starting with smaller size.

If you place a resting bid or offer and it gets filled, you’re probably losing to that trade. It’s a stale order.

But — if you’ve decided that the sum of losses from stops is less than the counterfactual of trading smaller from the start, then it’s accretive.

My gut is that most people have no idea whether that’s true for their strategy.

Which is just a sub-instance of a bigger issue: they don’t fully understand their edge.

Not a damning criticism — the admonition is a matter of degree. Having an edge is hard enough. Appreciating all the contours of that edge is even harder.

If it were easy, professionals wouldn’t blow up. But they do.

Even market-makers, whose businesses hinge on understanding risk and tradeoffs, sometimes blow out. They weren't clueless, but every serious professional still has open questions about their strategies that bump up against the types of tradeoffs we examine when constructing risk rules.

The best firms are probably closest to the efficient frontier of those tradeoffs.

Clueless tourists are far below it — and often don’t even see the problem.

For the narrow audience of vol traders, I think the traditional stop-loss framework makes little sense.

I explained why in this 5-minute clip from The Trade Busters.

To wrap up…

I’m not a directional trader, so maybe this doesn’t mean much, but I’ve never placed a hard stop order in my life.

If I want something with a stop-like profile, I use options. Otherwise, I size the risk appropriately at the start (imperfect, but I prefer this to overbetting and then using a negative expectancy maneuver more frequently as a risk management tool. If you have been on an options desk you know that traders are obsessed with “how do I hedge less?”).

If the risk grows, which happens because vol is not constant — then I check:

Is the risk bigger than what’s allowed?

If so, reduce the position.

Follow the risk protocol.

It’s not about price levels.

It’s not about P&L memory.

It’s a binary: Is the risk too big or not?

I go deeper on that in this short clip.

I’ll leave it there. I’m done with this topic. Conceptually it’s not hard. It’s a trade-off and the details of that trade-off matter with their relevance varying with the strategy.

[Trend-following is a good example of a strategy that strongly lends itself to stops. It’s built into the premise. It’s managers understand exactly what the trade-offs are in quasi-replicating an option that samples vol over longer periods because they know more frequent sampling understates vol in the presence of auto-correlation.]

If someone is religious about the utility of stops in some general sense without parsing the properties of the underlying risk, I’m suspicious that they are parroting some guru. Or trying to make their NYC rent by selling investment tips.

Eh, who are we kidding… these YouTubers are always telling you to smash the subscribe button from a subdivision in South Florida.

*Euan discusses stop-losses in chapter 9 of Positional Option Trading. This is just a blurb but the chapter is more technical:

- stops are complicated:

- Many trades that would have been winners will have been stopped out, so it is not as simple as assuming that you are just cutting off the left tail of the distribution. You would need to know how many trades would cluster at the stop threshold [This is a question of path].

- Simple simulations show that the expected value of a strategy will fall if you use a stop, although you shed the large losers.

- Trailing stops cost even more than a fixed stop because they are always in play, as opposed to a fixed stop which gets further away.

- Stops don't just stop losses. They drastically change the shape of the return distribution and can lower the average return. Adding stops won't transform a losing strategy into a winning strategy. The only reason that we would add a stop is that we prefer the shape of the stopped distribution.

- Stops make more sense if we are trading momentum and less sense if we are trading mean reversion. [Kris: note that much of option trading is mean reversion on some meta-level]

- A position should be exited when we are wrong. Sometimes this will coincide with losing money. In this case, a stop is harmless. But sometimes losing money corresponds to situations for which we have more edge. Here, a stop is actively damaging and contrary to the idea behind the strategy. [Kris: Fully agree and why I believe in risk rules that are independent of P/L for option trading and more thoughtful of ex-ante risk shocks]