Positive delta puts

Selling puts in squeezes

Yesterday in “trader” is a uselessly broad term, I boosted several of Euan Sinclair’s insights about option trading. I saved one for today because it’s an actionable trade that I agree with and I believe it exists because it’s unintuitive to everyone but volatility traders who are a tiny minority of the traders at the scene when the particular setup presents itself!

We are going to describe the trade and what its success depends on.

First, what did Euan say exactly?

🔎The Bubble Trade - Selling Puts on Meme Stocks

Euan argues that when stocks enter extreme bubbles (GME, AMC-type moves), selling puts captures massive premium with volatility correlated to price movement.

The opportunity here is to sell puts. I’m selling puts. I’m getting a huge premium for those cuz vol’s high. If the stock keeps going up, well, that’s fine, right? Those puts are going to expire worthless. But if the stock goes down, I’ve got a huge cushion there because vol’s going to come in.

Why Not Calls?

Once something’s in a bubble, it can continue to be in a bubble. Like it’s doing something stupid. And once someone’s stupid, their stupidity knows no bounds, right? Once it’s become unmoored from reality. So selling calls is insane.

The Edge - Volatility Correlation:

GME the vol when it started I don’t know probably like 50 or 60. When it went nuts? I don’t know what it was because my system topped out at 1000. So it was above a thousand right? So we know vol has gone up as the stock’s gone up. So what happens when the stock comes down? Vol comes down. If let’s say I sell the 40%. So I’m selling the 200 strike puts when GME is 500 and implied vol’s a thousand if it drops back to 200 that implied V is probably going to drop back to you know 200. It’s quite likely I’ll make money because the vega is made up for any delta effect.

I have written about this idea before in What Equity Option Traders Can Learn From Commodity Options.

In that post, I talk about…

1. Option market-maker @DeepDishEnjoyer calling attention to puts going UP in value as GME and its vol ripped higher:

This is quite odd from a first principles perspective. GME closed 17 handle on Friday. Today it meme squeezed up because of Roaring Kitty. A basic model is: it continues meme’ing - then these puts expire worthless or the meme ends and we go back to where we were at at Friday. But note that you could have sold these puts at 75 cents today even though they closed in the 50s on Friday!!!! They should be actually be worth *less* since there is no state of the world where downside vol increased.

That’s easily anywhere from 20-40 cents of EV on these puts. And indeed that’s where these puts landed now. So why does it happen? Well, market makers don’t pay a large amount of attention to the wings of their vol surface. ATM implied vol got correctly bid, but they moved the...rest of the surface in parallel EVEN THOUGH THAT MAKES NO SENSE IN A SCENARIO WHERE A STOCK MEME GAPPED UP. Again, vol follows fairly two discrete paths that are intimately tied to stock price - vol is high when the stock is memeing, vol necessarily dies down when it stops.

At the money implied vol should increase. But the strike vol of the 10 strike put should not be massively increasing as the probability of going *below* 10 has not increased today from yesterday, while the options market is implying it has.

2. My instinct to sell those downside puts via put spreads…but the market is quite good at pricing the vertical spread! Commodity markets in particular since they are deep and accustomed to pricing options in physical squeeze scenarios.

Euan harps on this class of trade where you sell puts in bubble or squeeze scenarios where the vol explodes. He covered it in Retail Option Trading, which came out a year ago. We discussed it with respect to DJT stock, arriving to the same conclusion that whether or not Trump won, those DJT puts would come in hard regardless of the stock’s direction.

(He did the trade, I balked. It was a nice winner for him even when the stock fell in the weeks after Trump’s victory was declared).

My desire to cap the risk and bet on the distribution ruins the trade because the blunt source of the trade’s p/l is vol coming in hundreds of points. Any version of this trade where you buy options is like choosing to drive on a tightrope instead of a wide avenue. Just take more risk to load the results fully to the edge, but decrease your size.

Listening to Euan explain this on the podcast got it rattling around my skull again. The intuition behind this trade runs deeper than “vol is high, so sell it” because the stock is going to make large moves. It’s about how the vol surface changes as the stock moves, but to appreciate how much wind you have at your back, we can show not only option values but also describe what’s happening along the path with Greeks.

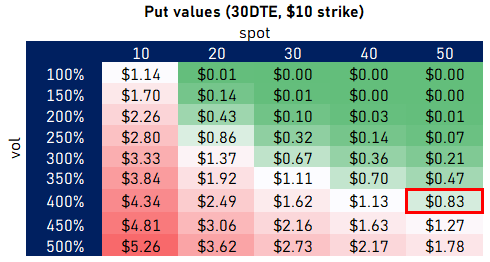

Let’s consider the $10 strike put of a meme stock that has surged to bubble territory. Maybe it was $10 and shot to $50. Its vol explodes. Let’s look at a matrix of spot and implied vol pairs for the $10 strike with 30 DTE.

If the stock is $50, we’ll pretend the ATM vol is 500%

The downside strikes will trade at a discounted vol as the skew inverts. We’ll go with a 400% vol on the $100 strike, the cell with the red border.

As both the stock and vol fall back to earth, those puts don’t perform and this is assuming there is still 30 DTE. There’s no time decay embedded, just stock and vol changes. If the stock and vol both suddenly halved, the puts still LOSE half their value. It’s very difficult to win on being long those puts if the vol stabilizes regardless of where the stock goes. I mean you almost need them to go in the money to win.

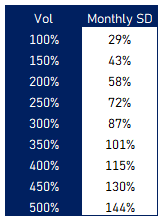

Oh and just to put ridiculous vols in context, this is a table of vols and what they imply for monthly standard deviation of returns. Just divide vol by √12:

It’s educational to see this through the lens of option Greeks.

The Mechanics of Vanna

Vanna is a higher-order sensitivity that answers “how does the delta of this option change with volatility”.

OTM calls have positive vanna because, as you raise volatility, the call delta increases. The vol and delta change in the same direction. ITM puts share the same vanna as their corresponding OTM calls because raising vols makes ITM put deltas less negative.

OTM puts have negative vanna because raising vols makes put deltas more negative (more likely to finish ITM). Their delta is moving opposite the sign of the vol change. ITM calls also share the negative vanna since raising the vol lowers the ITM call delta (less likely to finish ITM).

You can be long vanna by being long OTM calls or short OTM puts.

If you are long vanna, you get:

- longer delta as vol increases

- shorter delta as vol decreases

You can be short vanna by being short OTM calls or long OTM puts.

If you are short vanna, you get:

- longer delta as vol decreases

- shorter delta as vol increases

Let’s test our comprehension with the familiar —the SPX. Asset managers, at the margin, buy protection and overwrite calls against their long positions. Therefore, market-makers, on balance, tend to be long calls and short puts. In other words, they are long vanna.

We know the SPX exhibits inverse spot-vol correlation. As the index goes up, vols tend to fall. If market-makers are long vanna, their delta changes with the same sign as the vol. If vol falls, the market-makers get shorter. The calls they own provide “less length” and the puts they are short “become smaller” as vol falls. The lingo used to describe this position is that it “decays short”.

Think of it this way, if a market maker is long call/short put and has the delta hedged with short index futures, if all the options go to zero, thus not spitting off any more deltas, then the market-maker is just short futures. Therefore, the glide path of the portfolio as time passes or vol falls is “decaying short”.

If they are long vanna, and vol increases as the market falls, then their delta changes with the sign in vol. Vol goes up, they get longer!

Notice what is happening.

As the SPX goes up, the market makers are getting longer gamma because the index is going towards their longs. The gamma effect makes them longer, but if the vol is falling, the vanna effect makes them shorter. The vanna and gamma effects on delta are directionally offsetting although the gamma effect is usually larger.

On the downside, the market maker gets shorter gamma as the index falls to their shorts but since vol is increasing the delta is also increasing due to vanna. The sign of the vol change and delta change is the same. But this is bad for the market maker! In a falling market, both the vanna and gamma effects conspire to make them longer delta. Meanwhile, in the rising market, the gamma benefits are offset by the vanna.

Let’s stop for a moment to make something clear. This is all description. Knowing this is not an edge any more than knowing that moving air is called wind. The question of strategy comes down to price. The steepness of the skew is either the cost or compensation for your vanna, depending on whether the spot/vol correlation works for or against your position.

In the SPX you collect vol points in the differential between the OTM call you own and the OTM put you sold. It boils down to:

Did you collect enough vol points to compensate you for the fact that you will NEED TO SELL MORE shares (vs a constant vol world, ie no skew) to hedge when the market falls toward your short gamma region and you will NOT GET TO SELL as many shares when the market goes up (vs a constant vol world)?

If you are short vanna in SPX (you get shorter delta as vol increases) you pay for the privilege in vol points.

In markets with positive spot-vol correlation—think squeezing commodities or meme stocks in full mania—you pay to be long vanna. If you get longer delta when vol increases, this is aligned with the positive spot-vol environment, amplifying your gamma as the market rallies towards your long calls.

But let’s examine the downside. After all, the thrust of this post is what happens to the puts in meme stocks as the market falls.

If you are short puts in a falling market, you are getting shorter gamma. This makes you longer delta on every downtick. Not desirable. But you are long vanna. As vol falls, your delta gets shorter. Long vanna means the change in your delta follows the same sign as the vol change.

In the SPX upside situation, the market maker was long vanna, so their long deltas shrank while vol was falling, dampening gamma’s delta lengthening effect. Here, it’s the downside move that coincides with vol falling. The long vanna effect on delta directionally offsets the short gamma effect on delta.

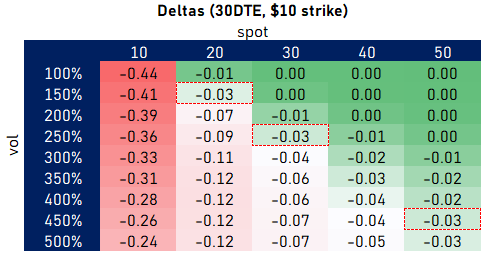

That these puts don’t perform for longs (and pay off the put sellers) is the vanna effect winning. Consider the delta of those options we looked at earlier for different pairs of vols and stock price.

If the IV falls from 450% to 250%, the $10 put has the same delta despite the stock being 40% lower. Again, we assumed no passing of time. If time passed, those puts would be even “further OTM” in delta or standard deviation terms.

💡The Volga Asterisk

There’s another Greek at work: volga or “vol gamma”. When you’re short OTM options, you’re short volga, which means as vol falls your vega is getting smaller. Maybe you make $1 on the first 10-point decrease in vol, but only 50 cents on the next 10 points. I cover volga in more depth here: Finding Vol Convexity

💡2 Vannas?

I never looked at an option’s vanna in a pricing model or the vanna of my position. I’m using it here to name effects that option traders know from experience, even though older option traders probably don’t say “vanna”. Vanna actually has 2 definitions. The one we are using here is the change in delta per change in vol. In practice, I’d say this cashed out as “these options have more/less gamma than what the model said” but it would have been higher resolution to just attribute vanna.

The second definition of vanna is change in vega for a change in underlying. I wouldn’t track this number explicitly, but this is something you must be keenly aware of. You position for it on purpose. Your risk shocks, a matrix of greeks for various combinations of spot and vol, show your vega under different market assumptions, thus capturing this definition of vanna even without naming it vanna.

In my lingo, “owning the skew” means owning the premium region of the surface where the market expects vol to increase if the spot heads there. That would be the downside in SPX or the upside in my cotton story. If cotton rips higher, I get longer vega because my OTM calls become closer to ATM. You pay up in vol points to “own the skew”. Those vol points are the price for having the vega winds at your back. Like any price, it can be too low or too high.

I really don’t care for skew as the basis for a vol trade. I’ve talked about how the skew is pretty good at knowing where the bodies are. I can tell you from my cotton and nat gas days that I was quite contrarian on the topic. I would hold my nose and buy expensive skew if I had a strong conviction on the directional outcome. Owning the skew was an insurance policy in case I was wrong about a directional trade I had unusually strong conviction in (like owning expensive calls to create an ITM synthetic put position to bet on a sell-off).

Strike Vol Dynamics

I’ve been throwing around vague statements like “vol coming in” or “vol going up” with respect to spot changes, but you should be asking, “Kris is this err, Vol, in the room with you right now?”

Well, no. There is no such thing as Vol. We have many numbers known as strike vols that when pushed through a model with other assumptions, generate a contract price. Those prices are the only thing our boss, P&L, cares about. The strike vols give us a ruler to compare and normalize. The Greeks, in turn, depend on them. This allow us to understand our risk and make sense of how these option prices respond to all the ways these contracts are battered by market circumstances.

If the vol on those OTM puts is low enough relative to what will actually happen, the strike vol won’t decline as much as you need it to. If the meme stock gaps to $0, the strike vol doesn’t even matter. The realized move drives the entire outcome and the puts go to $10 of intrinsic.

On the other hand, if the stock is squeezed and hard-to-borrow, and starts falling due to the supply of lendable shares loosening, this will lower the cost to be short and reduce the value of puts relative to calls! In other words, the very thing you might be scared of, the stock falling once the squeeze ends, might coincide with put prices weakening!

What is the story of the edge for selling puts on a meme/squeeze names?

In Laws of Trading, quant trader and Jane Street alum Agustin Lebron emphasizes something that many might not expect of quants — a belief that an edge should be easily explained by a qualitative story.

I actually think this particular trade is emblematic of a trade whose edge makes perfect sense. It sits there because it’s so unintuitive.

Let me get this straight. We acknowledge that a bubble or squeeze is happening, that the price of the asset is going to fall, and that the right trade is to…sell puts?!

Well, yea. Welcome to markets.

This is one of those trades that exhibits the “curse of knowledge”. You and I understand how vol surfaces work. We understand that when the market moves in the way people expect, that it is a stabilizing move. It is a move in a direction where people are more comfortable or at least less wary of selling options. In the SPX, that’s to the upside where the world is happy to clip profits, business as usual.

In squeezes and memes, stability is lower. That’s where the world makes sense again. Implied vol will come in just as it went out on the way up. When GME ripped higher nobody knew what was going on, but they knew GME at $60 is not its new “home”.

The public correctly understands that put options allow you to bet on the stock going lower. They don’t understand that the main input into its price is volatility so that they can be directionally right and still lose. They are non-economic with respect to what the contract is worth because their scrutiny stops at “you said puts go up when stocks go down”. Plus, when a stock turns into a football the gambler sees a window for a wildly assymetric payoff. They want upside or downside lotto tickets. They don’t want to sell options even if it’s the edgey side. All this commotion for bounded upside? Huh? To quote Dave Mustaine, “It’s still we the people, right?”

What could make the edge in this trade disappear?

Simple.

The risk-taking capacity of the vol-aware traders overwhelming the public’s demand to make the obvious but ill-structured bet on the stock going lower.

But keep in mind, the demand benefits from the trade being both:

a) obvious (the stock is gonna go back down)

and

b) most easily expressed by buying puts (anyone who thinks to outright short the shares is on display like a brontosaurus in a natural history museum somewhere)

For the opportunity to die, either:

a) retail stops trading, in which case, how did the meme stock take off in the first place

or

b) the situations become so common and retail gets burned so frequently that they finally realize that there is such a thing as a positive delta put.

That said, I literally just explained how this all works and I’m still not holding my breath.

Related: