my read on the market from the option lens

Commentary on the current market

SP500 is up about ~33% since the April low.

To choose a different reference point, since the Feb high water marks that preceded Liberation Day, these indices have rallied:

SP500 ~10%

IWM ~ 8%

QQQ ~12%

SMH ~ 25%

A few single stock performances since Feb:

MSFT and GOOG ~+25%

AAPL ~+5%

META flattish

AMZN -5%

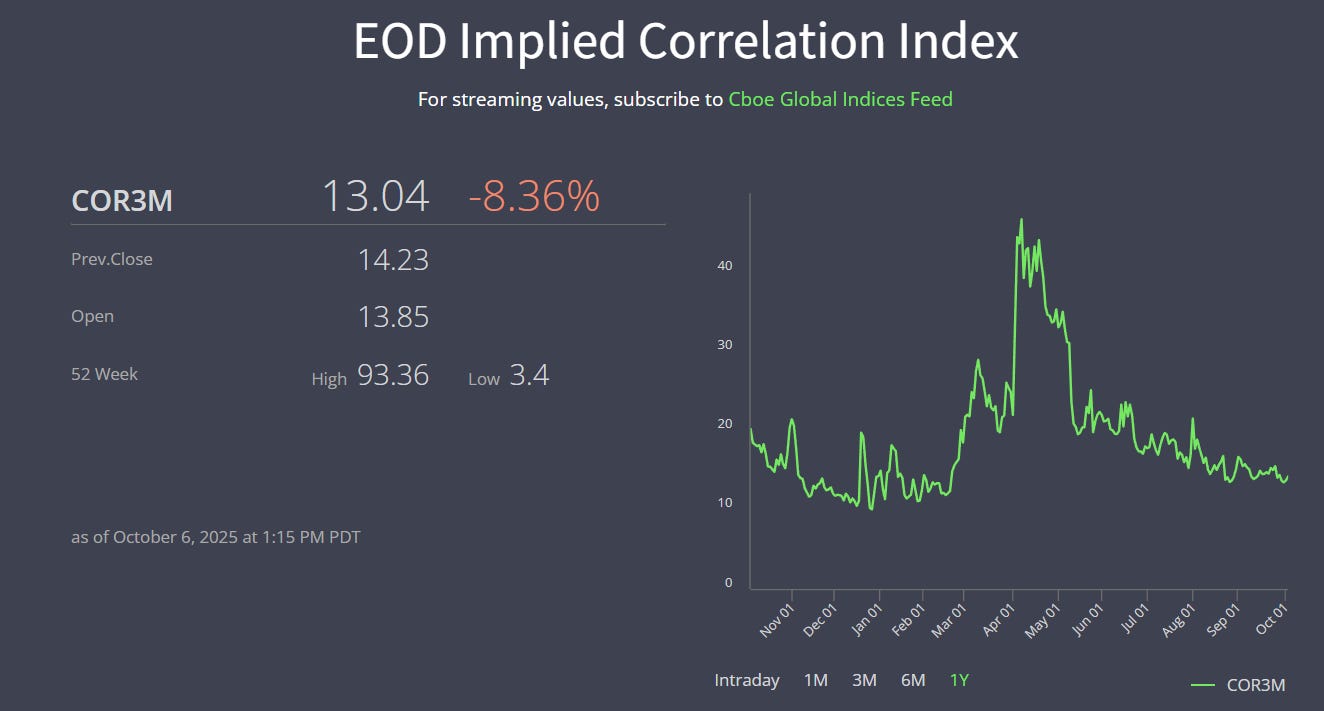

Just looking at these giant companies, there’s certainly dispersion under the hood of these indices. This is expected to continue if you believe the CBOE implied correlation index:

Despite the rally, and despite implied correlation getting smushed which usually coincides with SPX vols coming in hard, vols don’t seem especially low.

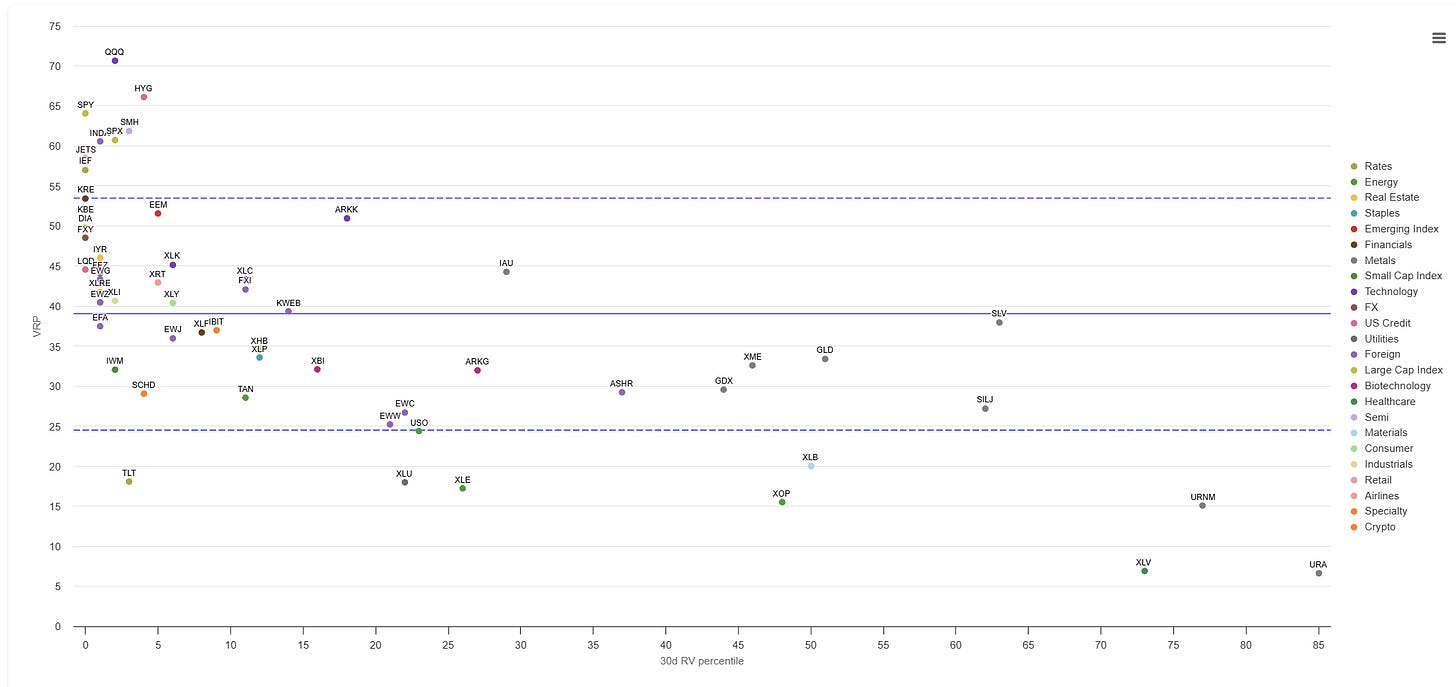

The x-axis here is IV percentile for 1-month vol (1-year lookback). SPY is around the 35th. Less than median, but I would have sold the piss out of that percentile if you asked me to guess it with stocks at all-time highs and implied corr in the trash. But it’s holding up well.

Look at the names in that scatterplot. That’s my liquid ETFs watchlist.

The vols are actually pretty mid and not generally low. And those are all ETFs. In other words, baskets.

[When vols are low, those dots are all huddled to the upper left.]

But

if the corrs are very low,

and

the numerator of corr is index variance, which is mid,

and

the denominator is single stock variance

then, guess what?

Single stock vols are flying.

💡If you need a quick primer see Dispersion Trading for the Uninitiated

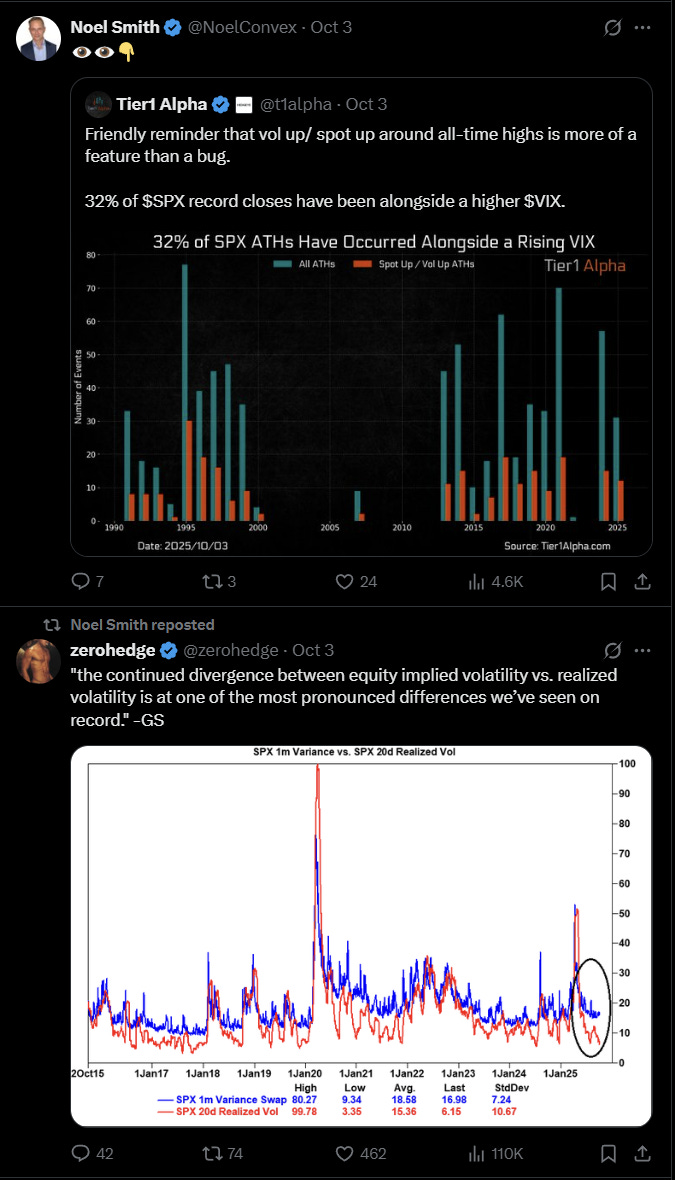

Vol manager Noel Smith and everyone in the options market is noticing:

These are from Friday:

What’s driving all this?

Record call buying:

I asked Grok for recent tweets about the call option bonanza. You can see its response here.

We are in a stock up, vol up scenario in the single names. This hasn’t bled into index because the correlation transmission lines are still getting stuffed.

[QVR’s Benn Eifert explaining just 2 weeks ago how dispersion, a form of carry, is so crowded that the risk-reward favors doing something extremely rare for vol traders — getting long corr.]

While the index is not having a spot up/vol up moment the SPY/VXX 21-day rolling beta is the smallest its been in the past year (meaning vols are not falling very much on up days):

I wrote this on X Monday:

Asset prices climbing a wall of worry -- vols look broadly expensive compared to daily sampled vols. Guessing they look cheaper relative to weekly sampled since we’ve been trending

Shorting vol = long beta; tough diversification setup

I trimmed some hard deltas a month ago and trimmed also via soft deltas (buying puts in SMH)

Buying puts was the better play Why?

1-month puts for 28 vol correspond to a 1-month st dev of 28/sqrt(12) ~ 8%

We’ve moved 16% in the past month.

Another way to appreciate this is how a daily delta hedged position worked if you bought the 33d put back on 9/5 when I traded.

OFC the unhedged put buy is a loser.

But if you trade options when you want to disentangle the vol vs directional contributions, after all you could have gotten the directional piece just buying the stock.

[Then I go on my soapbox a bit]

To use options directionally you need to think of the VOR...“value over replacement”

I could just trade the stock but all these salepeople trying to get me to use options. Is the lens they’re using focused on vol or hoping direction works out for you so they can elide what options are all about?

The market is buying calls. Soft deltas. It’s a fling, not a commitment. That’s the message I get when I see stock up/vol up, when I see relentless new highs with record call volumes. Very 2021 vibes but still acknowledging some discernment — after all, correlations are low.

How do I translate this into “so what’s the trade?”

First, notice that options as measured by VRP are very expensive. Here’s that liquid ETF list again on a scatterplot with VRP on the Y-axis (VRP is what % premium 1 month IV is to 1-month historical vol. The mean is a 40% premium. If you’re a moontower.ai sub (shameless plug but I hope you can see why our tool is called “opinionated”…we’re giving you the goggles here) looking at this stuff on a regular basis you know that premium is usually more like 15%.

Implied vols are pretty middish, certainly not low (ie they have room to fall) and they’re carrying like crap in the ETFs (which is why those dispersion traders are winning despite selling corrs low).

In fact, the X-axis represents the realized vol percentile, which shows that despite IV being moderate, the daily-sampled realized vols are at rock bottom.

Here’s how I describe the set-up:

- The destabilizing moves are higher. The market-maker and hedging community get shorter vol as we go up.

- Market-makers aren’t stupid. They literally saw this movie a few years ago and if you think SIG doesn’t have the “run Softbank vol surfaces” button in their cockpit, trained on the 2021 flow signatures, then you must also be puzzled as to why the market-makers are making unprecedented piles of cash trading against retail with their democratized access and fancy subscriptions. My guess, those single stock calls are rich enough to neutralize the gamma poison on the arrows being flung at them.

- They also aren’t in the business of selling vol naked. So if they’re not buying index vols to hedge the short upside vols, they must be buying ATM or downside. This position “decays long” (instead of doing vanna gymnasitics, think of it this way — if all the extrinsic value of their short calls and long puts disappeared their remaining position would just be long stock. The delta hedge.) As long as the rips higher don’t outperform the jacked upside vols they are selling, the market rally works for them.

- The market’s conviction is softening because length is being added in a hedged way (ie call buying instead of stock buying).

The tingling this set-up gives me:

A month ago SMH vols looked relatively cheap, leading me to trim with soft deltas (ie buying puts).

[Let me express this in different but equivalent terms — staying net long but buying puts is the equivalent to stock-replacing into synthetic calls. Of course, being a net seller of deltas on a rebalance, I lost to trimming deltas despite being right on vol. The trim was expressed in the right way, while the decision to trim was bad. What do you want from a vol trader?]

Now I think the vols are expensive and a move lower is stabilizing. So my vol axe would be to want to sell downside options (ie puts) which I think will underperform if we retrace lower because vol is already moderate and put skew adds a premium on top of that.

Like I said, the market makers aren’t stupid. They probably own downside to hedge their short upside vega which means the put skew is likely already low enough to make this position giant hedged risk-reversal they likely have on make sense.

And that’s the key.

If you want to bet on a retrace:

- you want to buy ATM/.25d put spreads where the put skew is NOT cheap.

- Likewise, you may want to buy put calendar spreads where the term structure is relatively flat if the market-makers are indeed well-supplied with puts as calendar spreads would benefit from a “stabilizing” grind down and a fat VRP.

Both of these trades are short delta (although being long a put calendar spread, you can flip to a long delta if the market crashes…still the most you can lose is your option premium if you don’t hedge)

Unfortunately for me…SMH put skew is trashed in the 1-month option. The surface can read my mind.

(It’s joyless to report that surfaces front-running my thinking is the reward for experience. That’s what you get for skill-building in an adversarial, red queen career)

On a more uplifiting note, if you poke around you can find put skews that are indeed elevated. In fact, if you have a cross-sectional lens, you can always sort names into relative highs and lows across all kinds of dimensions to see what’s typical and what sticks out, so you can express your view by finding the cheapest expression surfaces offer.

A few extra thoughts to ponder

- You can sell VIX futures as a way to sell put skew and vol all at once since the pricing is highly sensitive to put prices. But just to practice thinking about all these triangle relationships, remember that selling SPX index vol while capturing a fat VRP right now is also selling index vol very cheap relative to stock vols. That concept is portrayed by the low implied correlation levels.

- SPY put skew is a bit higher than normal. Given the moderate levels of vol, it is totally possible that while retail is buying single-name calls, institutions are buying puts to lock in gains at the index level. If the market turns lower and investors are hedged, this supports the idea that downside moves will be orderly (assuming the downside move isn’t triggered by some insane shock — it’s gonna be exhausting if I need to slap pandemic disclaimers on market comments).

Putting the pieces together, I’d guess large vol traders have a giant dispersion riskie on…short downside corrs, long upside corrs. Which is probably a bit structural for them, with the limiting reagent in the construction being single-stock option liquidity.