moontower raw: another day of trading

more live trading

The readership here is a mix of curious, friendly people, many of which are here for dad-posting and general geekery. To you, I apologize, these off-cycle posts just sound like quackery.

But for the masochists amongst you, these feel worth sharing since the market has got me in its tractor pull.

These are my threads for today. The waves are good for vol surfing these days. (Growing up in NJ the windows to ride were short so you gotta make hay ya know).

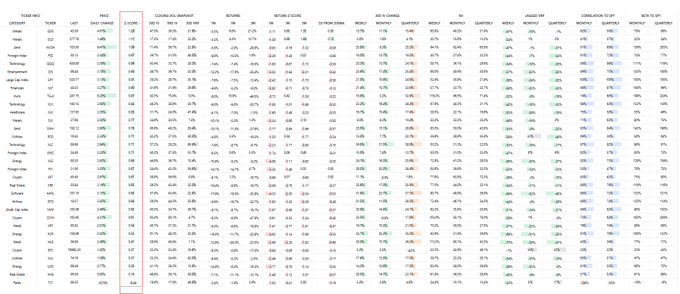

Rally this am mostly not covering cost of gamma via moontower.ai cockpit:

my VIX tab

This wasn't advocacy of selling vol or anything. It's pure description of a common day. If anything I wouldn't think of the current vrp is continuous terms like you might in a regular period. You could also think about the high cost of gamma in discrete terms...

Yesterday, the incorrect Reuters headline caused the market to snap higher. I think the possibility of a snap higher is probably in the market consciousness and in fact embedded to some degree into spot prices...

But the size of the rip was a tell. 7% So...you could think of the high IV like earnings with an unknown date. If expected realized vol ex-headline is 16%, but IV is priced at 30% between now and April expiry...what probability of a 7% one day rip is implied?

You can go crazy trying to be pedantic about all the possibilities (7% is just one example, and that was for China, yada yada), but thinking in terms of conventional vol metrics when you have context that suggests the market distribution is highly atypical is stale & anchored.

There's no answer key here. If you're discretionary, use discretion -- how does your typical thinking apply or not. Does it help to think in terms of straddle or vol right now? On a no headline day you pulled an empty chamber on the revolver. But there's a lump of variance, a bullet in the chamber, on one of the upcoming days. Which expiry is it in, not sure? Maybe an event calculator terms structure goal seek can help you fit a smooth implied forward curve with an event size and probability pair?

I'm not saying I'm even bothering to do this explicitly but it's certainly lingering in a fuzzy way when I'm scanning prices. Anyway, just thought I'd throw this out there because I think it would be easy to make naive conclusions about the original post. An empty chamber day.

…I didn’t know the market was about to turn downwards turning an empty chamber day into one with stuff to do!

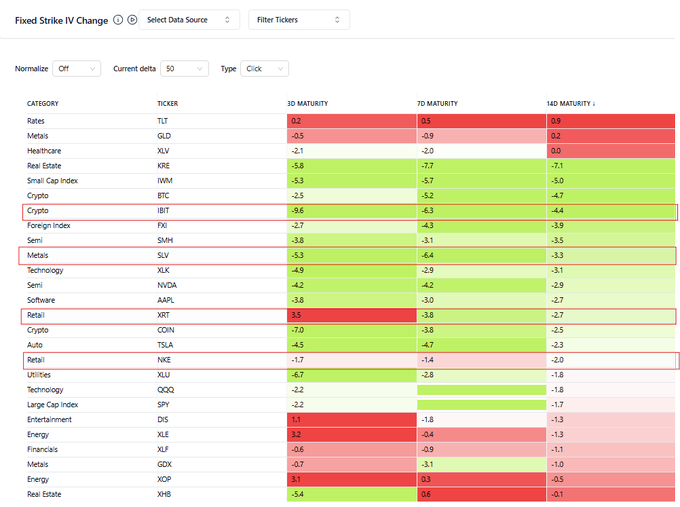

How my trading portfolio mirrors my bias... Running a theta-neutral book concentrated in the fronts. Short meat in SLV & XRT Long otm upside in IBIT & NKE Long VIX futures today's vol changes

from moontowwer.ai:

The vanilla options book is down small but it's also long delta in everything so the relative vol p/l's are working (it's theta-neutral so i'm long more OTM units than i'm short meat which gives me my bias towards a rip)

The VIX futures p/l is driving the portfolio p/l while under the hood my vanilla options p/l is winning while directional bias is losing (causing the vanilla options book to be down small)

Marrying volatility lens with context, and the options are the paintbrushes to draw your portfolio on the canvas to match your bias The longs and shorts are funneled and then use my bias to select from what remains.

Using options for purely directional reasons is easier. Surfing vol surfaces (written a post with that title) is more nuanced. May trade around the position depending how things unfold...may rebalance selling VIX futures to buy back silver which is down a lot...

if the market overall falls lower and vol outperforms got ammo via VIX futures to sell vanillas. Will probably bias to be vol seller/delta buyer on balance if that's what the market gives

and if the market is up, the opposite...be a delta seller, vol buyer on balance but overall trying to keep buys and sells roughly matched.

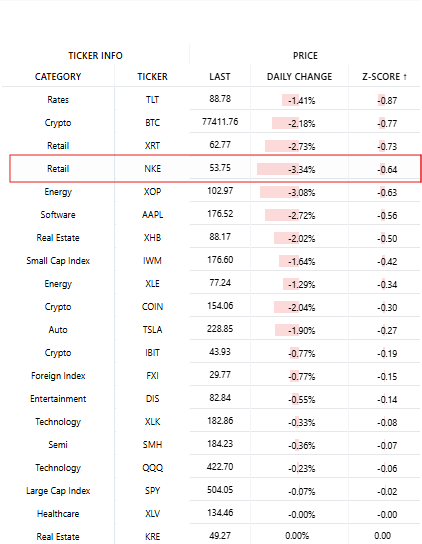

covering silver and gonna roll down NKE upside shots mental buckets: silver cover is risk off NKE is risk on (even though it's buying premium, it's long delta) note how the trades are "matched" they're not relative value, it's just trying to keep buy and sells aligned

Cockpit view of why I'm rolling the NKE shots down:

upside shots + let the long VIX futures ride

this is my version of buying the dip without wanting hard deltas if this is home or if we grind up 5% by april expiry i'll be sad but as Corey [Hoffstein] says...risk cannot be destroyed only transformed

I’m sharing my thinking as best I can in real-time. The vision and trading is only capable because I can see because of our software. It’s why we built it. If nobody wanted it, Emi and I wanted it.

But software is a tool. As I hope you can see, there’s no silver bullet. There’s no “do this all the time and it works”. The markets are a game and a puzzle. Everyone wants someone to tell them what to do. Tell me “red” or “green”. A friend told me moontower.ai complicated and I needed to dumb it down to red or green. I’m sure there are lots of newsletters and apps that make lots of money selling silver bullets.

Even when I was at the fund I couldn’t figure out how to systematize my thinking so it was just software. Could be a skill problem. I’m not denying that. But I know with the lens we got and continue to build I have my best chance of seeing.

I can’t tell you what to do and I wouldn’t want to. I can only show you how I think. And every time I hit send here or on X there’s that little risk manager in the back of my mind reminding me that I might sound really dumb. Especially when I traffic in something where other other experts are — like NKE…I don’t know sht about NKE but I know it’s hated right now. And for good reason. But nobody knows what’s going to happen to it in 2 weeks so I buy shots on there like it’s a memecoin. Is it dumb…well if you are a NKE expert you’ll prolly think so. But I’m showing you how I think. I can live with humiliation on trading decisions. That’s how this goes. I’ve been wrong millions of times. It doesn’t seem to be a mortal failure in the grand scheme. Being wrong is nowhere near as dangerous as being overconfident.

[Of course being overconfident is one of the paths to being ungodly rich, so keep my warnings only insofar as it serves you. I’m a grinder. There’s no glory in grinding. Know thyself and all that].