levered silver flows

computing rebalance quantities

In the spirit of spaced repetition, I published The Gamma of Levered ETFs as an article on X. Seemed relevant given silver’s 30% selloff on Friday.

Here’s the short version of the math of levered ETFs. To maintain the mandated exposure the amount of $$ worth of reference asset they need to trade at the close of the business day is

x(x - 1) * percent change in the reference asset * prior day AUM

where x = leverage factor

examples of x:

x=2 double long

x=-1 inverse ETF

x= 3 triple long

x= -2 double inverse

Applying this to silver:

AGQ, the ProShares Ultra Silver ETF, is 2x long. It had ~$4.5B in assets at the close on Thursday.

For the underlying swap to maintain the mandated exposure, at the close of Friday (assuming no redemptions) the swap provider must trade silver. How much of it?

2(2-1) * -30% * $4.5B

or -60% of $4.5B.

-$2.7B worth of silver in forced flows. Negative = sell.

There’s an UltraShort 2x ETF, ZSL, that had about $300mm of AUM going into Friday.

Rebalance trade:

-2(-2-1) * -30% * $300mm = -$540mm

Assuming no redemptions, these levered ETFs needed to sell ~$3.25B worth of silver into the close.

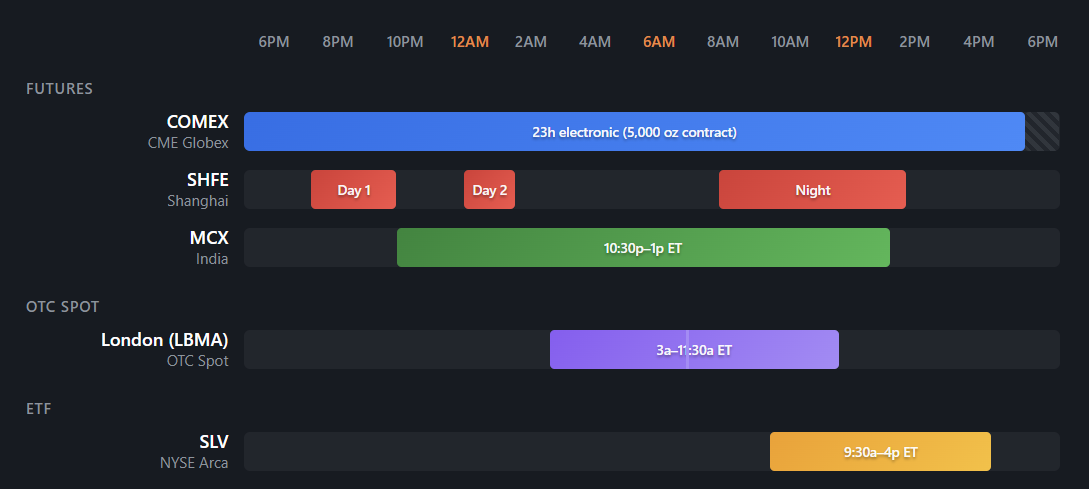

In a typical environment, silver volumes are mostly split between London’s spot market (LBMA) and COMEX futures (NY deliverable) with Shanghai (SHFE), India (MCX) and SLV (London deliverable, US traded ETF) combining for less than 10% of total volumes.

At the NY close, SLV and COMEX represent all the liquidity that’s open.

COMEX futures traded nearly $150B of volume Friday and SLV traded ~$50B which is on the order of 10x the dollar volumes silver used to trade a year ago at lower prices. Still, those forced sales, if they are happening in the few hours of trading may represent something like 5-10% of the liquidity.

I’m guessing readers who are actually on metals desks have a better guess.

Silver futures margins, after being raised again this week, are about 15% of the contract value (although your broker may ask for more. IB asks for twice that, which was prescient!)

If Shanghai futures, which were closed, have a similar requirement, that means the exchange doesn’t have enough collateral to cover the 30% move if Shanghai futures match the COMEX move.

I don’t know how that exchange works (many exchanges have an insurance pool where some of the losses are socialized across clearing members), but one thing that would be interesting is if Shanghai exchange officials have the authority, balance sheet, and ability to have sold COMEX futures as a hedge. I doubt that, it’s just a speculative musing, but if such a thing did happen, their Sunday evening unwind trade would be to buy back COMEX futures as they liquidated Shanghai holders. Again, this is just a ridiculous musing, but I look forward to seeing how it all shakes out.

In any case, I think a useful takeaway from all this could be to add expected levered rebalancing flows to your dashboards (of course, this is a recursive problem because the price at any point in time reflects some people’s knowledge of these flows. Pre-positioning always opens the door to backfiring if enough arbs think the same way).