Levered ETF/ETN tool

Compute the amount of dollars required to rebalance a levered exposure

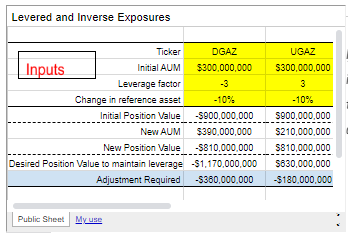

Use this tool to estimate how much a levered fund would need to buy or sell to maintain its mandated levered exposure. You should make a copy of the sheet for your own use.

A few points to consider:

- AUM changes faster than the position size by the amount of the leverage factor

- Inverse funds require 2x the adjustment of their long counterparts! So a levered inverse SPY fund would require 2x the adjustment of a levered long SPY fund.

- For more detailed explanation of why funds must adjust their positions see my explanation of shorting.

Preview: