Lessons from the .50 Delta option

The .50 delta option is not necessarily at-the-money. See how the .50 delta strike holds information about the underlying distribution.

I was chatting with a quant friend who was bouncing an options idea off me. In the course of the conversation, he was surprised I did not assume the .50 delta option was the ATM (at-the-money) option. My friend is much smarter than me on finance stuff but options aren’t his native professional language. So if this idea had him tripped up I realized I had a reason to write a post.

If I do this correctly you will gain a better understanding of:

- Delta as a hedge ratio, not a probability

- How volatility affects the mean, median, and mode of these returns

- The relationship of arithmetic to geometric returns in option theory

- What these distributions mean for the value of popular option structures

Some housecleaning:

- Option math is known for being calculus heavy. If you are a layperson, you are in luck, this tour guide likes to stick to the roads he knows. You won’t find complex equations here. If you are a quant, I suspect you can still benefit from an intuitive approach.

- We are going to ignore the cost of carry (interests and dividends). While crucial to actual implementation it is just distracting to the intuition.

Delta Is A Hedge Ratio Not a Probability

Often delta and “probability of finishing ITM (in-the-money)” are indistinguishable. But they are not the same thing. The fact that they are not equivalent holds many insights.

Before we go there, let us revisit the most basic definition of delta.

Option delta is the change in option price per $1 change in the underlying

Consider the following example:

Stock is trading for $1. It’s a biotech and tomorrow there is a ruling:

- 90% of the time the stock goes to zero

- 10% of the time the stock goes to $10

First take note, the stock is correctly priced at $1 based on expected value (.90 x $0 + .10 x $10). So here are my questions.

- What is the $5 call worth?

Back to the expected value:

.9 x $0 + .10 x $5 = $.50

The call is worth $.50- 90% of the time the call expires worthless.

- 10% of the time the call is worth $5

- Now, what is the delta of the $5 call?

$5 strike call =$.50

Delta = (change in option price) / (change in stock price)- In the down case, the call goes from $.50 to zero as the stock goes from $1 to zero.

Delta = $.50 / $1.00 = .50 - In the up case, the call goes from $.50 to $5 while the stock goes from $1 to $10

Delta = $4.50 / $9.00 = .50

The call has a .50 delta

- In the down case, the call goes from $.50 to zero as the stock goes from $1 to zero.

Using The Delta As a Hedge Ratio

Let’s suppose you sell the $5 call to a punter for $.50 and to hedge you buy 50 shares of stock. Each option contract corresponds to a 100 share deliverable.

- Down scenario P/L:

Short Call P/L = $.50 x 100 = $50

Long Stock P/L = -$1.00 x 50 = -$50

Total P/L = $0 - Up scenario P/L:

Short Call P/L = -$4.50 x 100 = -$450

Long Stock P/L = $9.00 x 50 = $450

Total P/L = $0

Eureka, it works! If you hedge your option position on a .50 delta your p/l in both cases is zero.

But if you recall, the probability of the $5 call finishing in the money was just 10%. It’s worth restating. In this binary example, the 400% OTM call has a 50% delta despite only having a 10% chance of finishing in the money.

I’ll leave it to you to repeat this example with a balanced distribution. Say a $5 stock that is equally likely to go to zero or $10. You will find the 50% delta call turns out to be ATM. Something you are used to seeing.

The key observation turns out to be:

The more positively skewed the distribution, the further OTM the 50% call will be. If a stock is able to go up 1000% and you sell a 400% OTM call on it you are going to need far more than a token amount of long stock to hedge.

The more positively skewed a distribution, the more the hedge ratio diverges from the “probability of finishing ITM”.

The Effect of Pure Volatility

Not to lead the witness too much, but an obvious feature of the binary example is the biotech stock is very volatile. That’s not a technical definition but a common-sense observation. “This thing is gonna move 100% or 900%!”.

Without math, consider how volatility alone affects a stock’s returns. If the stock price remains unchanged because we do not vary the expected value but instead inject more volatility what is happening?

- We are increasing the upside of possible payoffs.

In the biotech example, more volatility can mean the upside is not $10 but $20. - The counterbalance to the greater upside is a lower probability of rallying

If the stock is still worth $1 then the probability of the up scenario has just halved to 5% (95% x $0 + 5% * $20 = $1, the current price).

If we inject volatility into a price that is bounded by zero, the probability of the stock going down is necessarily increasing.

So volatility alone alters the shape of a stock’s distribution if you keep the stock price unchanged.

Let’s see how this works as we move from binary distributions to more common continuous scenarios.

How Volatility Affects Continuous Distributions

Let’s start with a simulation of a subjectively volatile stock.

Assume:

- The stock is $50

- The annual standard deviation is 80%.

A basic presumption of option models is that returns are normally distributed but this leads to a lognormal distribution of stock prices¹.

Running the simulation:

- I took a return chosen from a normal distribution with a mean of 0 1 and standard deviation of .80

- I then ran that return through a simple log process to simulate continuous compounding².

S (T1) = S (T0) x e(random generated return) - I ran this 10,000 times.

Before we get to the chart note some key observations:

- You get a positively skewed lognormal distribution bounded by zero. This is expected.

- The median terminal stock price is $50 corresponding to a median return (aka the geometric mean) close to zero as expected.

- The mean stock price is $68. corresponding to a mean return of 38%.

- The modal stock price is $20 corresponding to a modal return of -60%.

Simulation Vs Theory

Let’s compare the simulation to what option theory predicts.

- Median

As we stated earlier median expected return is 0 from theory and this lines up with the simulation. - Mode

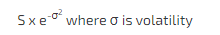

The mode in the simulation lines up reasonably³ with option theory which expects the mode to be:

Note how volatility pulls your most likely outcomes lower. In this case, the most likely landing spot for the stock is $20 corresponding to a total return of -60%!

Average Arithmetic Returns

Look at the chart again. Note how the average arithmetic mean stock price is $68.89 in this sample. If the median return is 0, the positively skewed distribution has a mean arithmetic return of +37.8%! We don’t want to get excited about this since as investors we care about geometric returns which are zero here, but this 38% OTM strike is still very interesting.

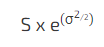

It turns out it corresponds to the strike of the .50 delta option!

The equation for that strike:

That strike corresponds to 68.86 which is very close to the simulation result of 68.89.

This is the call that you must hedge with 50% of the underlyer.

The formula will look familiar if you remember that the geometric mean is pulled down from the arithmetic mean in proportion to the variance.

[This strike is special for option traders. This is the strike that has the maximum vega and gamma on the option surface. As implied vol changes the location of this strike can change, but it represents the maximum vega any strike can have for a given spot price. I’ll leave it to the reader to see how this relates to strategies that are convex in vol such as ratio’d vega neutral butterflies.]

Interesting Observations About Options

- Even in a continuous distribution, the higher the volatility, the more positively skewed the distribution, the further OTM the 50d call strike lives.

- The cheapest straddle will occur at the median outcome or the ATM⁴ strike.

- The most expensive butterfly will have its “body” near the theoretical mode. This makes sense since a butterfly which is just a spread of 2 vertical spreads is a pure bet on the distribution. If you chart the price of all the butterflies equidistantly across strikes you will have drawn the probability density function implied by the options market!

Enter Black Scholes

In a positively skewed distribution, the probability of finishing in the money for a call was lower than the delta. In the binary example where the stock had only a 10% chance of being worth $10, the probability of the $5 call was much lower than the delta of the $5 call.

What does this have to do with Black Scholes?

In Black Scholes:

- The term for delta is N(d1).

- The term for the probability of finishing in the money is N(d2).

What’s the relationship between d2 and d1?

- d2 = d1 – σ√t

The math defines the relationship we figured out intuitively:

The higher the volatility⁵ the more delta and probability will diverge!

Delta and probability are only similar when an option is near expiration or when it’s vol is “low”.

From Theory to the Real World

Markets compensate for Black Scholes' lognormal assumptions by implying a volatility skew. While a biotech stock might have a positive skew on steroids, a typical stock’s distribution looks more normal than positive. By pumping up the implied volatility of the downside puts and lowering the implied vols on the upside calls, the market:

- Increases the value of all the call spreads.

- Shifts the implied mode rightward.

- Shifts the 50d call closer to ATM. Actually, it lowers all call deltas and raises all put deltas. This is important since deltas are the hedge ratios.

- Fattens the left tail relative to a positive distribution and at least in index options even more than a normal distribution.

These adjustments reconcile the desirability of a simple, easy to compute model like Black Scholes which uses lognormal distributions with empirically consistent asset distributions that we observe in markets.

Conclusion

The next time you hear delta used as probability, remember this is only really useful when options are near-dated. Since most option activity occurs in the front end of the term structure the assumption is typically harmless.

Taking the time to understand why they differ turns out to be a great exercise in building an intuition of investment returns and their distributions.

Footnotes

- You can see my post The Volatility Drain for a fuller explanation but the short version is if you start at $100 and lose 10% then gain 10% your total return is -1%. Compounding multiplies returns together as opposed to adding them.

- I used Excel like a dinosaur. To mimic what I did you should check out Bionic’s Turtle’s video

- I wonder if maybe 10,000 trials isn’t enough to converge on the mode as quickly as the others

- Again, if we considered carry it would be the ATF (at-the-forward)

- I hope it’s intuitive that increasing the time to expiration has a similar effect as increasing the volatility