laying in the weeds

searching for ideas "left for dead"

Within a week of the furious post-election rally I went to Twitter:

What is the most asymmetric way to bet on deflation? Is there an option on this that's left for dead?

There's conventional choices like bond calls but i want to hear what ya got...also not a short run expression...something long dated that gives time to see the possibility of deflation looking out the Overton window.

Also I know you think it's impossible. I don't care about "think" though.

I want to know where deflation is "offered at impossible".

Deflation doesn’t have to be likely for a bet on it to be profitable. And it’s certainly nowhere near impossible — this is a rich country with wealth concentration (rich people have low MPC), declining birth rate, and an NVDA market cap says robots will have lots more high paying jobs, and an incoming government promises lower spending (although this doesn’t translate to a smaller deficit if the tax receipts fall by even more).

There were plenty of responses.

(Unsurprisingly and for good reason, the most common answer was calls on treasuries or nitroglycerine like 30 year zeros.)

After I posed the question, I thought I’d follow up with a meta-trading lesson that governed how I thought about execution as a discretionary trader. It’s more relevant for professional trading where slippage is a larger concern but I expect anyone can at least benefit from hearing about it.

Laying in the weeds

Right now the market optimism thermometer is Sahara hot.

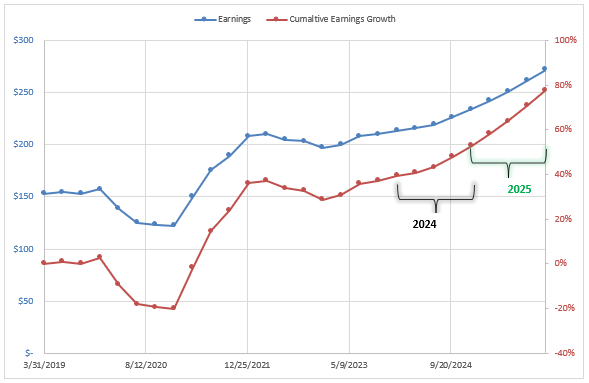

I charted SPX earnings using data from Gurufocus:

SPX earnings are up 48% in 5 years from 9/19 to 9/24 or ~8% per year

SPX total return over that period is 110% or 16% per year so multiple expansion has been riding shotgun 1-for-1 with earnings.

And now for 2025, forward earnings expectations are expected to grow 16% after being fairly flat from late 2021 until late 2023. Forward p/e has actually dipped despite SPX at all-time highs because of the animal spirits baked into the denominator.

I’m just using this as an example of divining sentiment. You could use option surfaces, COT reports, the “is my aunt or Uber driver talking about investments” indicator to get a pulse. (See Staring At The Window for an example of thumb-in-the-air vibe detection).

Your vibe detector gives a little elbow nudge, “hey knuckle-dragger, pay attention for a sec, it would make sense that some state of the future is being heavily discounted or left for dead.”

And so you start thinking along the lines of the tweet I opened with. What’s hated? What’s offered at zero? What’s being extrapolated to where only disappointment is possible?

[The most popular post I’ve written is once again relevant: Why Investing Feels Like Astrology]

If you are in a professional seat, you have time. You’re not gonna top-tick it anyway. Relish the complacency. The FOMO. It’s the yang to the yin and why you are able to get the other side. You should toe in and hope to lose while your position is small, because every bad mark is spring-loading energy for Newton’s 3rd Law,

You don't go lifting and hitting. You don't aggress. You lay in the weeds. Your waiting for flow that opposes your idea.

But you also want to understand “why”.

You wonder, is there some dumb structured product flow out there whose greeks need to be recycled into listed and happen to match what I'm looking for?

Is the driver of that flow some easy-to-package message about how inflation is here to stay so convince the clients to basically sell the deflation option for free.

Classic Wall St momo herding. Package a trend as a cornerstone allocation. Commodity futures for the long run right? (Nobody talked about roll return in 2004 and it’s all anyone talked about a decade later).

Ride the narrative to sell product because the narrative "makes sense".

While the vampires seduce the consultants and investment committees you search the conference room trash bin for glossy marketing literature. What product are they hawking now? It probably spits off a ton of greeks that are hated, contrarian, and most importantly — cheap.

So you lay in the weeds with your little axe to own that which nobody wants. You get edge on the price because it was "sold", you didn't have to cross the market. As a discretionary trader looking for long shots you generally don't wanna go around overpaying for lotto tickets. Instead you wait for handsome Oxford grads with accents to convince everyone that the lotto ticket is worthless. The prepared responder vs the enthusiastic aggressor.

And the really fun thing about greeks is now someone has the other side. You don’t just want your low probability idea play out — you want someone in pain on the receiving end. It might not be your direct counterparty but it could be a part of the ecosystem that is implicitly short that option whose clamoring exacerbates the problem. When unexpected things happen, something somewhere breaks.

(I may be showing a bit too much of my commodity roots but my model for those markets is — boring, business as usual until a cowboy shows up. It’s a zero-sum game so the other big players who’ve been around for while see the cowboy pyramiding and winning. And so the funds lock arms — time to run the new guy in. Oh the margin requirements changed overnight, never saw that coming did ya cowboy.)

When the crowded side starts to realize that what was 95% true is only 90% true. They sold something at 5% that’s now worth 10%.

Then you get a little mutual reinforcement...narrative can follow price too. As they need to cover the Overton window is also moving against them. It's invisible but visceral at the same time.

I know I want the "long where it ain't" option. The option with volga. Because that “it’ll never get there option”, the one nobody wanted, is now the one you can't touch and that feeds on itself.

One last thing…

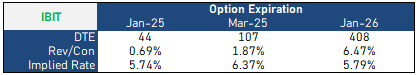

Noticed this yesterday:

Better than T-bills but gotta pay state tax.

[Heard those rates have actually come down too! The crypto peeps tell me the cash/futures arb is insane right now so this is presumably a trickle down to any levered long on BTC, although I’m not sure how fat the margin requirement is on the short IBIT put would be if you were just long the synthetic future.]

Even simple SPY cash/futures arbs are fat.

I’ll re-tell some market history that I remember hearing. Hedge funds did well avoiding the dot-com crash. If you weren’t mandated to be long stocks at extreme valuation you could hide out in 5%+ treasuries. Today with P/Es where they are, the forward implied returns on stocks look pretty awful compared the risk/reward of these simple arbs.

I get the excitement. Deregulation, lower taxes, AI, all that. But I also remember the fiber bubble of the late 90s. The longs weren’t wrong — laying cable across the ocean was gonna change the world. But the competition was fierce and changing the world didn’t mean “earn a return”. shale changed the world. And we got a bunch of consumer surplus because it’s a COMMODITY. AI is amazingly useful. But what if it’s a commodity. My guess based on auction-clearing prices being set by the most optimistic bid —OpenAI, Anthropic, and a host of big companies are in a money-incineration competition. But we’re all gonna be better off for it. No reason to double down on the benefits in your portfolio where the eventuality of the benefit is least reliable.

Personal portfolio thoughts

My equity allocation is on the low end of the range I manage in it as I’ve been trimming in the 2nd half of 2024. Also poking around for asymmetric bets of the wide strangle variety. Basically replacing some length with soft upside deltas as blow-off top insurance plus some downside bullets.

One thing I find tricky is that I suspect that we are going to stay in a low correlation regime absent a large sell-off as I suspect the incoming administration will create all kinds of upside and downside headline risk for single names. But implied correlations are already low which means single-stock vols are relatively high. So this particular view is baked into market already. Means if I’m buying it’s with one hand not two.

In alignment with the trimming, my cash position is on the high end. Speaking of cash, some personal convo on real estate…

One of the reasons we are holding extra cash is we have been house-hunting more actively instead of just passively browsing. Our lease ends in August at which point it will have been 5 years. The landlords have indicated they might want their house back although we are still crossing fingers that they won’t.

Cash is a valuable option when buying a home. Especially here in the Bay Area. In fact the option is probably quantifiable. When we sold our house in 2020, the winning bid was 10% higher than the cash bid behind it and well-thru our asking price. Why?

Because the buyers were contingent on selling their home and they were getting a mortgage so they knew they had no chance if they didn’t dangle a sum that enticed us to accept the risk of their offer vs a clean cash offer.

When we bid (we have bid 3x this past year) we offer all cash and quick close times.

[This also helped us win the house in TX against 4 other bidders…which we ended up flipping a year later. See Reasoning Through a Housing Trade Out Loud]

We are never the best bid, but the cash offer is useful because it gets us a callback and into a situation where we have more info than the initial approach which is our objective. So we can probe.

Sellers don’t like closing uncertainty. They are wary of bidders drawing them into a contract with contingencies then trying to re-trade. In fact, you have no chance of buying here if you don’t waive inspection contingencies. Bring your contractor friend to check it out before you bid.

I guess this cash thing is becoming more common too. In the past year, we’ve given cash to 2 separate family members in other regions so they could win their bids. They financed after closing to pay us back.

[Random: the family we sold our TX house to financed the property with a loan against their stock portfolio. Morgan Stanley sent an appraiser!]

Anyway, back to our recent bids this year. We whiffed on all of them. And that’s fine — that’s a feature of our strategy. Mostly. Missing on the last one hurt. In hindsight, I still can’t tell what the right play was. I’ll walk you through it.

We made a cash offer about 2% higher than the asking price which seemed a touch low. We asked for a 3 day inspection period. At this point the game is hang around long enough to find out if the house is attainable at a price we are comfortable with and then sharpen our pencils if we get to the next round.

There were 7 offers. Ours was middle of the pack but attractive enough from a “they will probably close point of view” so we were one of 5 offers that received a counter.

They asked for another 3% and to waive the inspection period. That morning we brought our contractor and architect friends to see if we could do what we wanted to the house. They gave the green light.

(Having another 9 months on our lease, this was a great opportunity to scoop a smaller house put another 50% into it over the course of a year and end up what we want for an all-in price that we are comfortable with — I’ve been looking long enough to know those stars rarely align which is why this was the first house I started to feel excited about)

We accepted the counteroffer requirements.

That night Yinh and I were going out on a dinner date. I was excited that it could be a celebratory one.

I was wrong.

We were outbid by another 1.5% and they weren’t going to do more rounds. The final bid was also cash.

We understood our choices when presented with the counteroffer:

- Accept

- Counter with lower offer than what they ask for

- Be aggressive and counter even higher

The winners chose option 3.

The tricky thing about the final price is it reminds me of the paradox from The Most Underappreciated Aspect of Trading:

When you look at a price, you wish you could have traded it as counterparty to the aggressing order.

Now for the anti-climax.

It’s a fake idea because had you been on the price, the price would have been different. You would have affected it. This idea is like a painting to be viewed from afar. It’s not of any practical value, um, other than the fact that it holds the deepest insight in all of trading.

Knowing the final price, gun to my head, I would pay it. But if I tried to pay that in real-time I probably wouldn’t have gotten filled and instead hit our top (at this point we are 8% through the asking price which is close to but probably still a touch short of what the highest price I could have imagined the house going for).

Pretty unsatisfying.

If I knew we could rent forever I’d just do that. I have no interest in signing up for renovations, $12k/yr home insurance bills, maintenance (or the cost of outsourcing it), and the forgone returns on the cost premium of buying vs renting.

But renting is roulette in many ways. We won to it for the past 5 years but we know we got lucky so it’s hard to get to down about the recent miss.

And yet…

I become more Georgist by the day.