how I sold cotton at an all-time high

The cotton market as a unique example of when derivatives become the underlying

In the post If they ban short-selling derivatives become the underlying, I concluded with

If futures are trading at full carry and you think such a ban is possible it’s an asymmetric bet to put on conversions (ie short futures, long stock or for options short combos long stock).

Broadly speaking, the derivatives market becomes the underlying market. When the underlying market becomes encumbered do to technical frictions, derivatives are no longer just “derivatives”. The arbitrage mechanism is severed. The derivatives market becomes the home for price discovery.

I’ve seen this happen throughout my career. Just a few examples in addition to hard or impossible to borrow/short situations:

- HYG becoming a liquid referendum on illiquid high-yield bond market

- Cotton option synthetics continuing to trade even when the underlying futures are locked limit up (my trading claim to fame is selling the all-time nominal high in cotton in late 2011…it was an option synthetic around $2.25)

- When a stock is halted, the premium or discount to any ETFs holding that stock computed using the halted stock’s “last” price before the halt implies the price the stock will open when it resumes trading. These situations were common during the dot-com heyday when stocks would be halted intra-day on pending news announcements.

Today, we are going to cover #2. Along the way I expect several bonus “oh that’s how that works” moments. And call my shot…you will enjoy this one.

When cotton options become the underlying

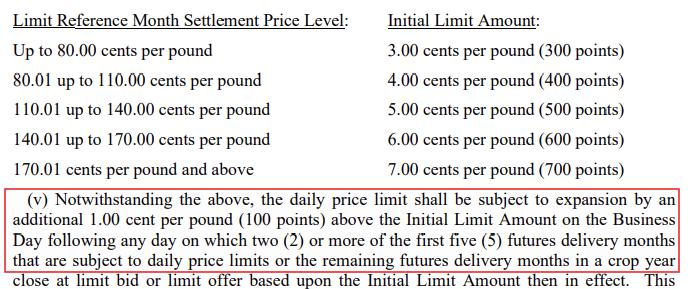

Cotton futures have peculiar price limit rules. The daily price limit depends on future’s price on the prior trading day.

If a cotton future is 70 cents, its daily price limit is 3 cents. If 2 or more of the first 5 delivery months close limit bid, then the limit is expanded by 1 penny. And this effect can chain every day with the limit capping at 7 cents regardless of the futures price.

Pricing a cotton straddle that cannot necessarily be delta-hedged (ie replicated) is good, clean fun. But it’s not the subject for today.

[Aside: When I traded cotton the rules were meaningfully different but I’m a bit foggy on them and can’t find the exact old rules online. The gist of it was there was a circuit breaker once you hit the limit that halted the market for 10 minutes perhaps. When the market re-opened the market was allowed an additional limit. If it hit that, you were double limit up. If 2 contracts went double limit up the market closed for the day. I once went to work for 20 minutes. The penny expansion rules were the same.]

Important background context

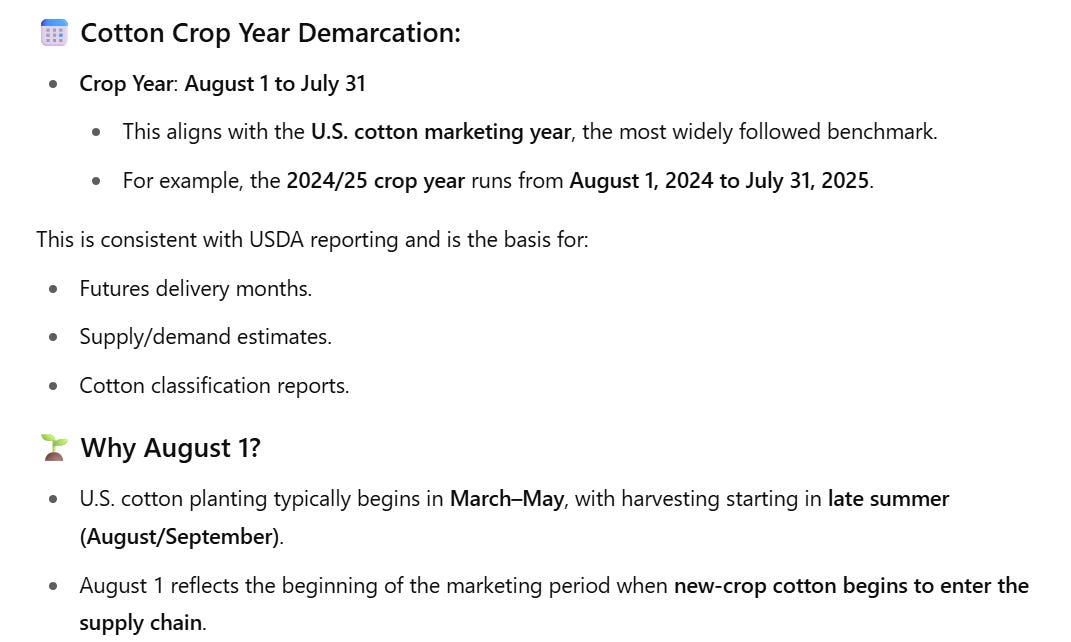

1️⃣I used ChatGPT to refresh me on the cotton planting cycle.

How does this affect futures trading?

- The old crop contracts have delivery months before August. Notably: March, May, July.

- The new crop contract , December reflects the next year’s harvest.

A squeeze in 2011 old crop acutely affected Dec 2010 thru July 2011.

2️⃣ In general, cotton futures, like most commodity futures are correlated to each other. In addition, nearer-dated futures are more volatile than further-dated futures. Even if you never traded commodity futures you’ve seen this in VIX futures. The front future can get to 70, the 6-month future has never done that.

The academic name for this “futures get more volatile as expiry approaches” is the Samuelson effect. The post Seasonal Volatility goes hard on this stuff if you care. But the point I want to get to is that cotton futures have a diminishing beta as you go out in time relative to the front month mostly because the volatility ratio drops off. Recall that beta is volatility ratio * correlation. However, when you cross a crop year, the correlation can also significantly drop off. In fact it can invert!

This is logical. If there is a shortage of cotton this year, farmers are incentivized to plant more acres next year increasing supply. Today’s bull market literally sows the seeds of tomorrow’s bear market.

This leads to interesting behaviors in future spreads. For example, if month 1 (M1) goes up 10 cents in a week, M2 might go up 6 cents. The spread expanded by 4 cents over the week. Generally speaking, spreads themselves are positively correlated with M1. (You can think of them as having their own delta to M1).

But when you get into these squeeze cases, the spreads can really blow out as their delta becomes dominated by the volatility of M1. If M1 is $1.00 and M2 is $.80 the spread is 20 cents. If M1 is squeezed up 25 cents in a week because there’s a shortage of deliverable supply into that expiry for logistical reasons it’s possible M2 barely moves. Suppose it doesn’t. The spread therefore has blown out from 20 cents to 45 cents, which is so wide it is more than half the price of M2 itself!

If you are long an option time spread you just got carried out. You are long vol on something that didn’t move and short the thing that roofed and because it can only go 25 cents in a week by hitting limits you just got gapped.

[When I joined Parallax, I worked with the CRO to come up with all kinds of limits for not just vol exposures at the ticker level but gross exposures in individual months because we understood that the problem in commodities is not just correlations that go to 1, but -1!]

3️⃣Here’s a crazy wrinkle — when the futures are limit up, the options still trade! The futures pit would be dead as the futures brokers would run over to the option pit to quote synthetics from the option market-makers.

The option market-makers were effectively making markets in the underlying. As you can imagine, liquidity disappeared as the adverse selection problem dominates. Markets that are 2% wide with 5 lots on the bid and offer.

But this is where I thought it would be fun to point out that there was a way to price that limit-up front month future.

Suppose M1 is March 2025 and it’s $1.30 limit bid and you need to make a market.

You can imply its fair value with 2 pieces of information.

- Where a non-limit future is trading, say Dec 2025. Let’s say it’s market is $1.12-$1.13

- Where the March/Dec futures spread is trading. Let’s say it’s $.20-$.21 (remember in commodities spreads are quoted as near month minus deferred month, the opposite of how equity roll conventions).

So “on legs” the March future is $1.32 bid, offered at $1.34.

If you offered the March future synthetically at $1.35 and got lifted you could buy the Dec future at $1.13 AND the Mar/Dec spread for $.21.

You outlaid $1.34, the Dec future cancels with the Dec leg of the spread and you are left long 1 March futures which you synthetically sold in the options market at $1.35.

The series of transactions has left you with a conversion on your books — short call, long put on the same strike which assures you sell a future at $1.35 at expiry that will wash with the future you bought at $1.34, netting you a 1 cent profit.

So when a future went limit up, you need to know where all the non-limit futures were trading as well as the matrix of spreads from those futures back to the ones that were limit to triangulate the tightest market in the limit future. You could quote synthetics around that value.

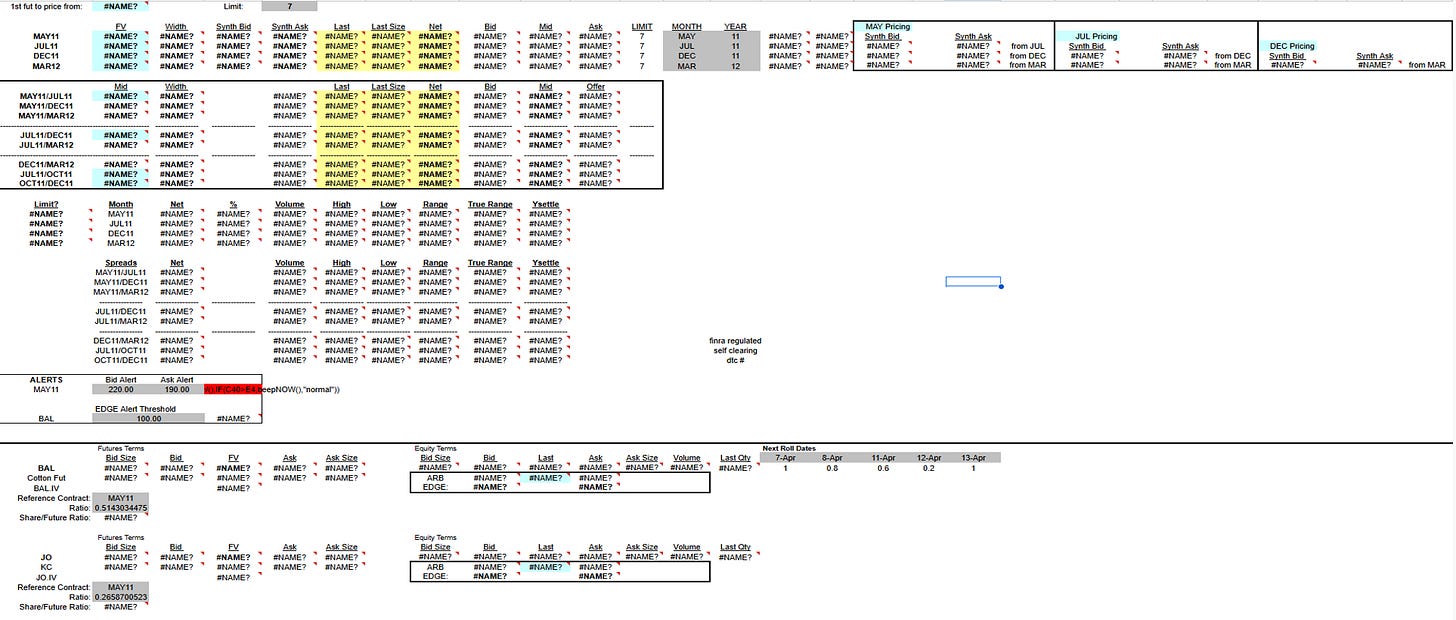

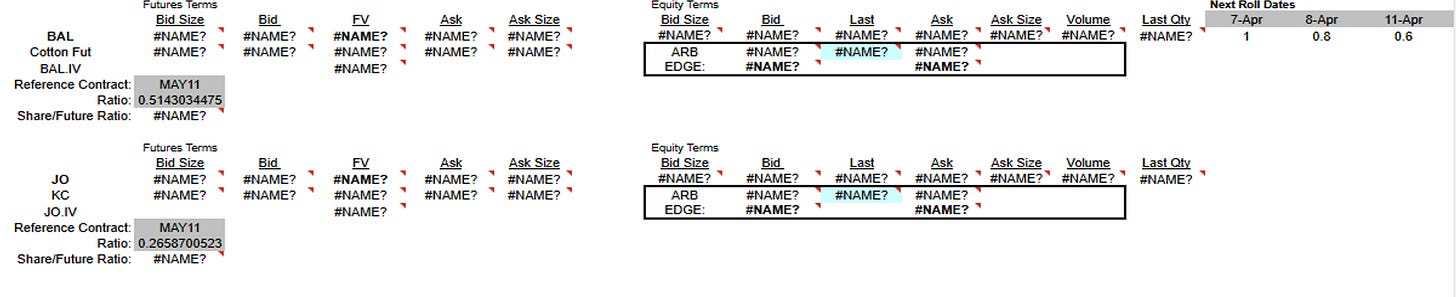

This is a screenshot of the actual spreadsheet I had on a tablet computer that I held in the pit:

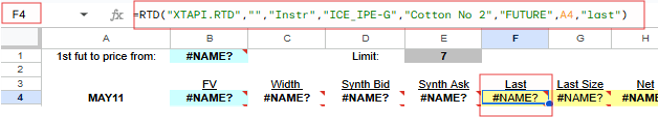

If you can zoom in you’ll see the RTD links to my X-Trader software, ie TT

as well as the “beep” alert which was kinda hard to hear in the pit especially because I had a headset on to talk to our upstairs trader.

Oh, there’s another little Easter egg…see BAL? That was the cotton ETF.

I’ve talked a lot about how I used to trade USO vs CL and UNG vs NG but I also traded BAL vs cotton futures…this one was neat because there were only a few people in the markets who knew in real-time where the locked limit cotton future was trading AND also jumped thru the hoops to be able to trade SEC products like ETFs. But as I explained in Battle Scars As A Call Option — The UNG Experience I had set all that up when I was at Prime so we were uniquely capable of this.

Zoom in a bit more and you can see that we were also looking at JO (coffee ETF) vs KC (arabica futures).

So going back to this post’s baity title…I sold cotton futures synthetically at ~$2.25 which is a higher price than it ever settled IIRC. In fact, I don’t think the futures ever traded that high, it only happened via options. It wasn’t some genius move — I was hedging gamma at levels that seemed reasonable based on where the futures were on legs.

Hedging gamma?

I might as well explain how I traded cotton. I went to the cotton pits specifically because the risk manager at Prime mentioned that there was a crazy squeeze happening in the cotton markets. Apparently, a large grower with cotton in the ground, who did the sensible thing — hedge the crop with short futures — was caught in a liquidity crunch. As the futures rallied in late 2010 based on the short supply, the large hedges were marking against the grower.

This was in the wake of the GFC so credit was tight. The grower couldn’t borrow to fund the margin despite having the crops. Classic example of the market smelling blood and “running in” a large exposed party.

I went to the pit to participate in these reindeer games. The option market was wild. Vol roofed. Call skew was jacked to record highs. Limit up every day.

So what did I do?

My trading partner will give me tons of credit for basically doing the thing many of the other options traders wouldn’t…I bought as many calls as my risk could let me. High vol, big riskies to the call…gobble gobble. But I did it because it was only positional trade that made sense (you could make some money market-making every day but this seemed like a chance to score on a position trade).

My reasoning:

There was no sensible path where we just grind higher. This thing gets to the uncle point as sloppy as the limits allow then crashes. We don’t know where the uncle point is but it’s up from here. By buying expensive calls with big fat deltas, I could sell lots of futures. Hard deltas. Those option deltas are soft…they will melt away as vol declines and time passes but the position I want is to be directionally short but have my upside protected.

And sure enough it played out pretty much that way, straight line up, straight line down (with the limits as speed bumps all along the way).

We played until maybe March expiry. The episode was over and I had no intention of being a cotton trader for the long haul.

Luckily, coffee was just getting busy and its pit was about 30 feet away. So I sauntered over there…for the next year.

Story time

By late 2011 I was talking to Parallax and once it was clear I was moving to SF, I started “closing only” trades with Prime. Winding down an option book is expensive. You can work out of your positions but it takes months depending on how far out your longest-dated inventory resides. Since you aren’t adding any trades with edge, it’s basically just hedging and losing money. The other choice you have is to pay another trader say a couple cents a contract to take over your book. Either way there’s an exit tax.

Once my book got very small, I was just playing Gears of War until 4am with my west coast friends every night, waking up at noon, and dabbling on my first blog, shoxland, named after my NYMEX badge — SHOX. There’s still a lot of people out there that only know me by that name and even many who know my real name who still call me that. (My XBOX live gamertag is “shox da monkey” a nickname a trader named Keith gave me in the office.)

Anyway, all the pit-hopping experience made me familiar enough with these products that when they got interesting they became part of my options book at Parallax. When they were dull, I ignored them.

Ok, ok thanks for indulging story time. It’s legit nice to write this down. For some readers out there this will be a trip down memory lane.