Growth rate = 70% * (doublings/years)

If you can count doublings then you can easily dazzle your friends with how fast you estimate a growth rate for any number of years.

Friends,

I saw this chart on LinkedIn and the call of mental math immediately lured me onto the rocks.

Since 1972, the SP500 is up 250x.

So what’s the CAGR (compound annual growth rate)?

One can open the calculator on their phone and type 250^(1/52) - 1

I cannot. I am impelled to estimate the answer. By what? I don’t know, probably the same ghost that makes people play games like Wordle.

I figured I’d share how I did this because practicing mental math is fun.

Recipe:

- Immediately recognize that 250x return is about 8 doublings (2⁸ = 256)

- If we estimate a 10% log return per year, Rule of 72 predicts in 50 years you double 7 times since at 10% you double every 7 years.

- Log returns are handy because they are proportional to time. If you doubled 8/7 or 14% more cumulatively, then your return per year must have been 14% greater than 10% or 11.4% compounded.

This reasoning got us quite close to 250^(1/52) - 1 = 11.2%

Shortcut for estimating a 50-year compounded return: 10% (1 + doublings/7)

Compounding feels unnatural. If we compound at 11.2% instead of 10%, over 50 years we get an additional doubling!

- At 10% CAGR wealth grows by 2^7 or ~250x

- At 11.5% CAGR wealth grows by 2^8 or ~500x

- At 13% CAGR, wealth grows by 2^9 or ~1000x

Rule of 72

Formally, the rule of 72 says that if you earn 10% per year, it will take 7.2 years for your money to double. A derivation of rule of 72 can be found here.

If you already know how it’s derived then you can guess that I prefer rule of 69.

[Let’s the Beavis chuckle pass]

If you double wealth, then your log return is ln(2) or .69

.69 / 7 years ~ 10% annual log return

The rule of 69 is very close to rule of 72 but is derived from continuous compounding instead of annual.

I prefer log returns because they are directly proportional to time.

From Using Log Returns And Volatility To Normalize Strike Distances:

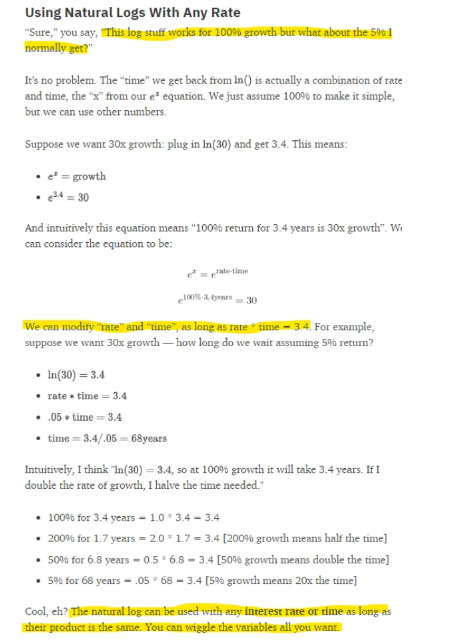

The expression eˣ is a total quantity of growth. It’s actually assumed to be e^(1 * x) where the 1 represents 100% continuously compounded growth and X represents a unit of time. The natural log or ln(ex) then solves for how much time (ie x) did it take to arrive at the total quantity of growth assuming 100% continuous compounding.

A key insight is that we don’t need to assume a 100% rate and x to be time. We can simply think of x as the product of “rate multiplied by time”. This allows us to substitute any rate for the assumed rate of 100% to find the time. Once again we turn to BetterExplained:

If you review that section of the post a few times and make up a few examples for yourself, you’ll never get confused about e or ln again. You might even start thinking about all numbers in terms of their logs.

For any number X:

- log (base-10) ~ “how many orders of magnitude to get to X?”

- log (base-2) ~ “how many doublings to get to X?”

- ln (aka log base e) ~ “compounding continuously at 100% how long will it take to get X”

In this last example, it takes one unit of time to get to 2.718 compounding continuously at 100%. If our unit of time was a year, then 100% return compounded continuously would turn $1 into $2.718

In the earlier examples, if you compounded continuously at 69% you’d double your money in 1-year. At 6.9% continuous compounding, it takes 10 years. At .69% continuous compounding it takes 100 years.

Generalizing

Continuously compounded growth rate = 10%* 7 log₂(wealth)/years

Compactly:

.7 log₂(wealth)/years

or

Compound growth rate = 70% * (doublings/years)

As long as you keep this in terms of doublings, ie log₂(wealth), then you can compute the compounded growth rate in your head.

Testing it remembering that the SP500 250x return was about 8 doublings in 50 years:

70% * (8/50)

70% * 16% = 11.2%

If you can count doublings then you can easily dazzle your friends with how fast you estimate a growth rate for any number of years.