Finding Vol Convexity

See how out-of-the-money options have non-linear responses to changes in implied volatility

In this post, we will learn what it means for a position to be convex with respect to volatility.

In preparation for this post, you may want a refresher.

- Vega is the sensitivity of a P/L to changes in volatility. This is the exposure volatility traders are taking active views on. It requires tremendous attention since changes in vol directly affect P/L via vega but also impacts or distorts the “moneyness” of all options in a portfolio. In that way, large vega exposures are signs that the risks under the hood of a portfolio are especially dynamic.

Refresher Post: Why Option Traders Focus On Vega (Link) - Convexity is the idea that there are non-linear P/L sensitivities within a portfolio. The curvature of the P/L derives from the fact that the exposures change as the market moves. Option deltas are not constant. That means deltas derived from options, as opposed to deltas derived from so-called “delta one” instruments like common stock or futures, are subject to change as the market moves. Vol convexity is the same phenomenon. Instead of applying to a delta, it applies to vega.

Refresher Post: Where Does Convexity Come From? (Link)

In Moontower style we will do this without anything more than middle school math. This 80/20 approach provides the intuition without the brain damage that only a relative handful of people need to know.

Mapping Directional Trading To Volatility Trading

Directional Traders

Most investors are looking to profit from the direction of stocks. Stated another way, most investors are taking active delta exposures. The size of their delta determines the slope of their P/L with respect to the market’s movement.

Directional Convexity

Some of these investors use options to make directional bets. This gives their positions convexity with respect to the changes in stock (also known as gamma). The convexity derives from the fact that their delta or P/L slope changes as the stock moves.

Volatility Traders

Now consider another, much small, class of investor. The option traders who try to keep delta-neutral portfolios. They are not seeking active delta exposure. They have no alpha in that game. Instead, they are taking active vega exposures. The size of their vega determines the slope of their P/L with respect to changes in implied volatility.

Volatility Convexity

Like the directional traders who use options, vol traders maintain convex exposures with respect to changes in the stock. Again, that’s gamma. But vol traders are much more focused on vol convexity. The reason vol traders focus on this more than directional traders is that vol traders typically run large portfolios of options across names, strikes, and tenors. These portfolios can include exotic and vanilla options. The presence of vol convexity means vol changes propagate through the entire portfolio in uneven ways. Risk managers model how vega exposures morph with vol changes.

For directional traders with just a few line items of options on their books, vol convexity is going to be much further down on the list of concerns. Somewhere in between “What’s for lunch?” and getting flamed by intern on Glassdoor.

Maximum Vega

Vol traders often think in terms of straddles. In fact, in many markets, brokers publish “straddle runs” every few hours. This is just a list of straddle prices and their implied vol per expiration.

At-The-Money Vega

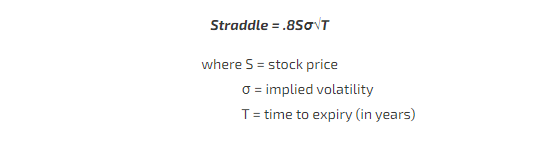

A handy formula every novice trader learns is the at-the-money straddle approximation¹:

So if there is 1 year until expiration, the 1 year ATM straddle on a 16% vol, $50 stock is $6.40 (.8 x 50 x .16).

So if implied volatility goes up 1 point to 17% how much does the straddle change?

.8 x 50 x.17 = $6.80

So the straddle increased by $.40 for a 1 point increase in vol. Recall that vega is the sensitivity of the option price with respect to vol. Voila, the straddle vega is $.40

More generally this can be seen from re-arranging the approximation formula.

Vega = Straddle/σ = .8S√T

Ok, so we have quickly found the ATM straddle price and ATM straddle vega. Look again at the expression for the straddle vega.

.8S√T

There are 2 big insights here. The first can be seen from the expression. The second cannot.

- The vega of the ATM straddle does not depend on the level of implied vol.

The vega only cares about the stock price and time to expiration. So whether you are talking about a $50 crazy biotech stock or a $50 bond ETF the 1-year vega is exactly the same even if the straddle prices will vary according to the implied vols. - The vega of the ATM option is the maximum vega of any option in that expiry.

This statement implies that the vega of an option varies by strike. All of the other strikes have a lower vega. They are less sensitive to vol than this one. That makes sense. This option has the greatest extrinsic value.

(I have a confession. The maximum vega actually occurs at the 50% delta option strike, not the at-the-money or at-the-forward. I used ATM because it is more intuitive. The hand-waving should not trouble you. Going forward I will use the .50 delta option for the charts. If you need a refresher see my post Lessons From The .50 Delta Option. Don’t worry, the intuition is not going to change if you fail to appreciate the difference)

Vega Across Strikes

While we were able to compute the vega for the ATM straddle to be $.40 from the straddle approximation, how about the rest of the strikes?

For those, we need to rely on Black Scholes. You can find the formula for vega anywhere online. Let’s feed in a $50 stock, 0 carry, 16% vol, a 1-year tenor, and a strike into a vega formula. We will do this for a range of strikes.

Here’s the curve we get:

This chart assumes a single option per strike which is why the vega of the .50 delta strike is $.20 (not $.40 like the straddle vega).

The big takeaways:

- The vega of a non-.50d option does depend on the level of vol.

- There is a maximum vega any option can have and it occurs at the .50d option

The Source of Convexity

If option traders’ profits are a function of vol changes, then their vega positions represent the slope of that exposure. If the vega of the position can change as vol moves around then their position sizes are changing as vol moves around. The changes in exposure or vega due to vol changes create a curved P/L.

Let’s see how changes in volatility affect vegas.

When Vol Increases All Strikes Become Closer To .50 Delta

Here’s the vega by strike chart the same stock. The blue line assumes 16% vol across all strikes. The red line is 32% vol across all strikes.

In fact, imagine overnight, the stock’s vol doubled from 16% to 32%.

The maximum vega at any strike is still fixed at $.20, it just occurs at the new .50 delta strike. The .50 delta strike moved up $2 or about 4% but look how the vega of the options at nearly every strike increased. This is intuitive. If you double the vol then a strike that used to be 1 standard deviation away is now 1/2 a standard deviation away. All the OTM deltas are creeping closer to .50 while of course, the .50 delta option remains .50 delta.

Watch How Your Position Changes

You can start to see the reason why a position can be convex with respect to changes in vol. Imagine you were long the .50 delta option and short the way OTM 90 strike call.

- At 16% vol the call you are long has $.20 of vega and the call you are short has 0 vega. You are unequivocally long volatility. Even if you are long 1 .50 delta call and short 10 90 strike calls you are long vol (1 x $.20 + (-10) x $0). Your portfolio’s net vega is long $.20 of vega.

- At 32% vol, the call you are long has slightly less than $.20 of vega since the .50 delta option has shifted to the right. Let’s still use $.20 to make the point. The calls you are short now possess $.05 of vega. Your new position vega computed as (1 x $.20 + (-10) x $.05) or -$.30 of vega. You are now short vol!

Your vega which represents your slope of P/L with respect to vol has changed simply by the vol changing. The higher the vol goes, the short vol you become.

Observe:

- The strikes near the meat of the distribution can only gain so much vega. Remember, maximum strike vega is only a function of spot price and time to expiry.

- Further OTM options become “closer” to 50d. This pushes their vega up relative to the ATM option.

This chart shows vega profiles across strikes over a wider range of vols. At extreme vols lots of strikes look like .50d options!

Trade Examples

Long ATM option, short OTM option. (Long vega, short “vol of vol”)

Starting conditions:

Stock price = $50

Implied vol = 16%

Portfolio

Long leg

- 1 .50 delta call @$50.64 strike (approximately ATM)

- Vega =$.20

- Premium = $2.90

Short leg

- Short 1 .14 delta call @$60 strike (approximately 20% OTM)

- Vega = $.11

- Premium = $.55

Summed as a vertical call spread:

- Premium = $2.90 – $.55 = $2.35

- Vega = $.20 – $.11 = $.09

- Note the position is long volatility

Now let’s change implied vol up and down.

It’s a busy picture. Let’s walk through the scenarios:

We start at 16% vol and increase vol

- Call spread value increases (solid green line) because the position is long vega. Your P/L is rising since this is the position you are long.

- However, the ATM call vega (blue dash line) stays relatively fixed while OTM call vega increases (red dashed line) causing the call spread vega (green dashed line) to decline from its initial value.

- As vol increases your vol length is decreasing. Whoa, this looks like negative gamma with respect to vol!

We start at 16% vol and decrease vol

- Call spread value decreases (solid green line) because the position is long vega. Your P/L is falling since this is the position you are long.

- However, the ATM call vega (blue dash line) stays relatively fixed while OTM call vega decreases (red dashed line) causing the call spread vega (green dashed line) to increase from its initial value.

As vol declines your vol length is increasing. Whoa again, this looks like negative gamma with respect to vol!

Ratio Trade: Short ATM option, long extra OTM options. (Vega neutral, long “vol of vol”)

Same starting conditions:

Stock price = $50

Implied vol = 16%

We are targeting a vega-neutral portfolio

New Portfolio

Long leg

- Some amount of .14 delta calls @$60 strike (approximately 20% OTM)

- Vega per option =$.11

Since the short leg has $.20 of vega and our long leg has $.11 of vega we need to buy 1.75 of the 60 strike OTM calls ($.20 / $.11) to have a net flat vega position. - Total vega for the long leg: $.20

- Premium per option = $.55

- Total premium = $.9625 ($.55 x 1.75 contracts)

Short leg

- Short 1 .50 delta call @$50.64 strike (approximately ATM)

- Vega = $.20

- Premium = $2.90

Summed as a ratioed vertical call spread

- Premium = $2.90 – $.9625 = $1.9375

- Vega = $.20 – $.20 = $0

- The position is flat volatility

You know what’s coming. Let’s change the implied volatility and look at the structure price. Remember you shorted the ATM option at $2.90 and bought 1.75 OTM calls for a total premium of $.9625.

In other words, you shorted this structure for an upfront premium of $1.9375. Watch what happens to its value when you raise or lower the implied vol.

To understand why the structure behaves like this, look at the scenarios.

We start at 16% vol and increase vol:

- While both your longs and shorts increase in value, your longs pick up extra vega, while your shorts are already as sensitive as they will ever be to vega. So every uptick in vol causes the structures net vega to become long vol.

- By being short this structure you are getting longer vol as vol increase. If your vol exposure gets longer as vol increases your exposure is convex with respect to vol.

We start at 16% vol and decrease vol:

- The opposite scenario occurs. As vol declines your short option leg has a fixed vega while your long vol leg that is OTM “goes away” as it’s vol declines. If vol is very low that call is extremely far OTM in standard deviation space. Imagine the extreme downward vol shock scenario — the stock is taken over at its current $50 for cash. All the options go to zero, the structure goes to zero, and you simply collect the premium you sold the structure at.

- By being short this structure you are getting shorter vol as vol declines. If your vol exposure gets more short as vol falls your exposure is convex with respect to vol.

One last chart to drive it home. The green line is your P/L as vol changes. Notice that your max P/L in the vol declining scenario is $1.9375, the entire value of the structure. It is unbounded on the upside. It looks like the more familiar picture of being long a straddle! The fact that the P/L chart is curved and not linear is convexity and as we know, results from the size of exposure changing with respect to vol.

The blue line shows exactly how that vega exposure changes with respect to vol. You started vega-neutral. As vol increased you got longer. As vol fell you got shorter.

Caveats And FYIs

This was intended to be an introduction. But here’s a non-exhaustive list of “gotchas”:

- Option surfaces usually have a skew. OTM options often trade at a premium volatility to ATM options which reduces the spread of vegas between the options. Less room for relative narrowing.

- We haven’t talked about the cost of those premium vols. Short gamma, paying theta anyone?

- In these examples, we shocked the vols up and down uniformly across the strikes. I’ll leave it to you to consider what adding a fixed amount of variance per strike would do to a vol surface.

- I completely ignored the fact that as you change the vols you are changing the location of the .50 delta option, or for that matter the delta of every option. In other words, I showed fixed strike vol behavior assuming a uniform shock. Adjusting for that is recursive and frankly unneeded for the intuition.

- Volga is the term for the sensitivity of an option’s vega with respect to vol. Volga itself changes as vol changes. That .50 delta option has starts with little sensitivity to vol. But if we crank vol higher that option moves further from .50 delta as the new .50 delta strike has moved somewhere to the right. So it follows that the old .50 delta is picking up volga, or sensitivity to vol. Again, no need to go full Christopher Nolan I’m just leaving breadcrumbs for the committed.

The main intuition I want you to get is that OTM options are sensitive to the vol of vol because their vegas can bounce around between 0 and the maximum vega. ATM options are already at their maximum vega. So structures that own extra options relative to be being short the ATM are convex in vol.

Conclusion

Vol convexity is important because changes in vol influence much of the greeks. Understanding the concept can be used for defense and offense. Vol directly impacts option prices according to their vega. But it also changes their vega.

Who should care?

- Anyone who wonders how a nickel option can go to $20.

When you combine the convexity of options with respect to vol (volga) with the convexity of options due to changes in the stock price (gamma) you get nitroglycerine.

- That segment of the market who takes active views on volatility, not direction.

Remember even when dealing with non-linear instruments, a snapshot of a portfolio at a single point in time might show it to be vega-neutral. But a photo of a car can make it look parked. Only the video can show how fast the car can move.

Footnotes

- Technically, this approximation is for the at-the-forward strike not the ATM strike. The ATF strike is the strike where the call and put are equal because it is the carry-adjusted spot price. For a derivation see The MAD Straddle