commodity kamikaze

a rebalance trade idea for my portfolio

Note: This is a trade I’m looking at. I’m not an advisor. I get hunches, I cross-reference them with pictures I have a hand in creating, I fire and then I go back to writing, tinkering, and ignoring what the world tells me to look at. Anything that rattles in your brain from my thoughts or existence are at your own damn peril.

WTI has given up all its gains for the year after falling the last few months and another 3% Tuesday after OPEC revised demand growth estimates lower through 2025. Commodities are telling a bearish story for the world economy. The BCOM index is down 5% for the year and over 12% from its May peak.

There’s a risk-off move broadly albeit uneven. Bond yields have been falling, and vols are elevated (by now you should at least have a free moontower.ai sub…there’s more to vol than VIX amiga). But instead of DCA’ing into equities which have remained quite strong relatively I’m going to add some WTI length.

I’m gonna get a little cute with this one. The deferred part of the curve has been getting hit as well as the front which fits the story — OPEC was planning to unwind the production cuts it has had in place since last year, but has kicked the can another 2 months. In other words, there will be even more supply in the future.

I checked with my favorite oil trader, Tina (who incidentally got featured in Gunjan’s WSJ piece this past week about SIG using poker to train traders), who felt that the OPEC posture was putting a damper on oil sentiment.

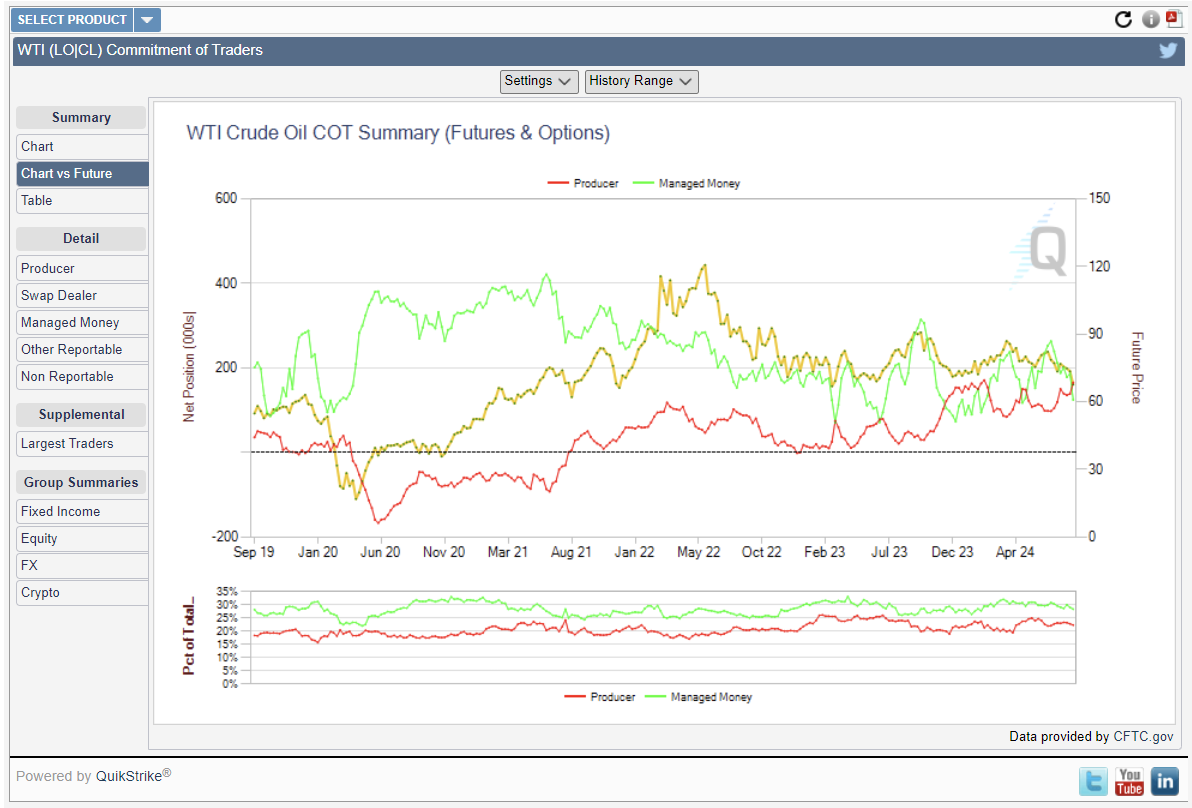

I pulled up the managed money and producers COT on CME Quik Strike:

The managed money length is on the low end of its 5-year range and the producers’ length is at a 5-year high.

My interpretation is that there will probably be a fair amount of resistance if it tries to rally since the producer will up the hedging. But the managed money positioning seems unlikely to have enough bullets to get much shorter (ie less long).

A recipe for being caught in the middle like Chewie in the trash compactor (RRRAARRWHHGWWR!)…while the vol is ripping higher…

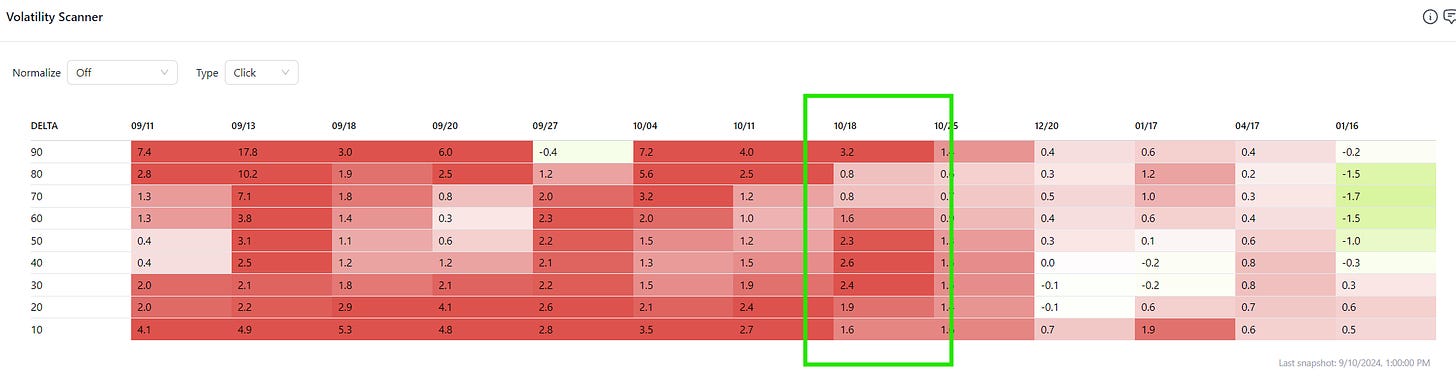

USO via moontower.ai on 9/10:

The realized vol is elevated but there’s still a healthy risk volatility premium in the options even above that.

Especially in the near-dated options (ie 1-month).

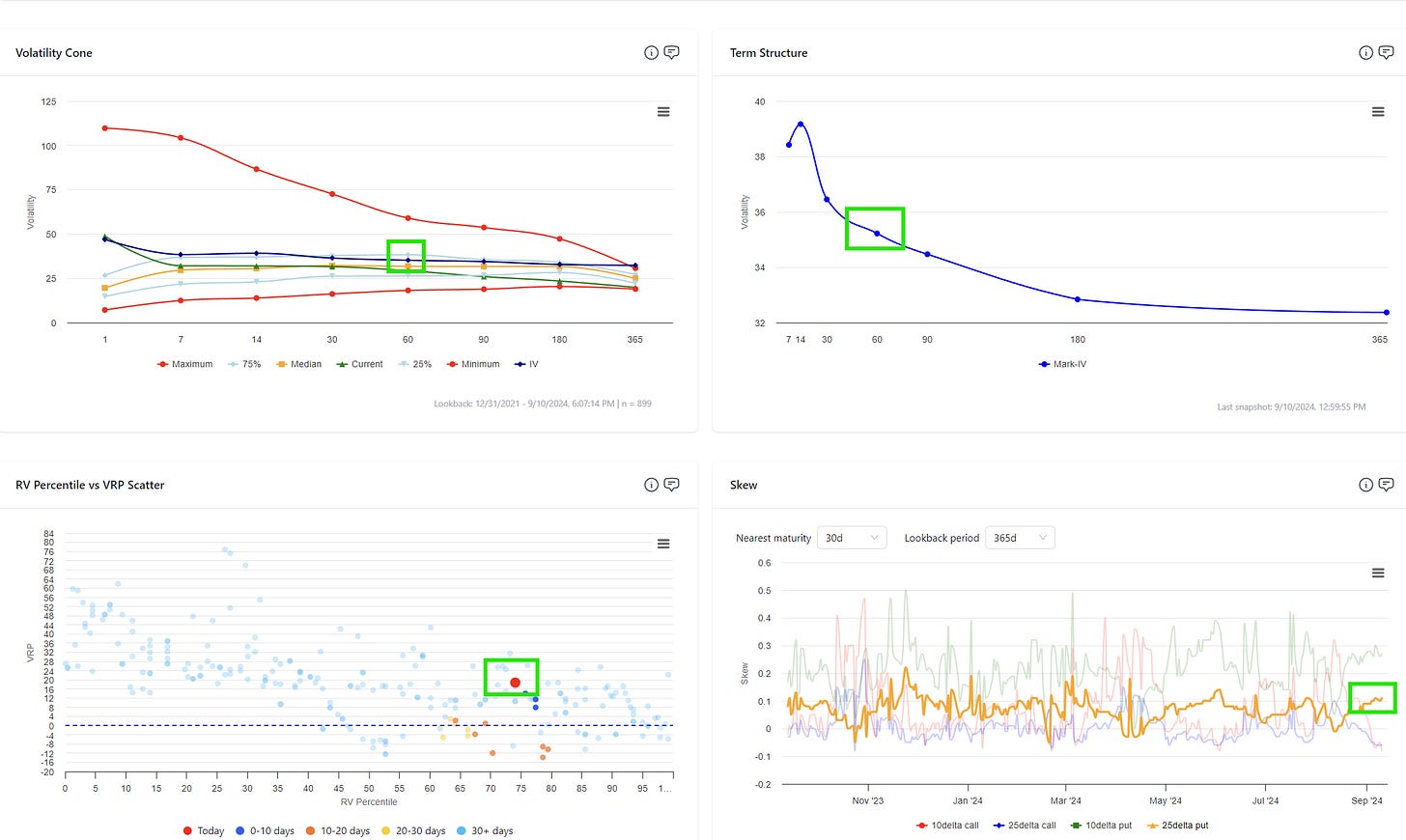

This is USO on the moontower.ai dashboard:

Vol is elevated even above the high realized, the vol curve is sharply descending (ie steepness < 100), and the put skew is jacked.

Given the narrative, COT, and vol setups my idea is some mix of:

- Sell some 1-2 month oil puts naked and some long equities that have been held >1 year. My equity holdings are mostly index funds. I’d do the trade on a net long delta since I’m ok with DCA’ing into a rebalance that is effectively buying the thing for sale in exchange for things that are less “for sale”.

- Sell near-dated 75 to 60 delta calls, and buy Dec25 oil futures which are still at a discount to the prompt months (a few percent of roll yield plus some vol premium especially from the downside options). As far as weighting the trade, you need about 2 futures of Dec25 (Z25 for those who partake) for every future equivalent you sell in the near-dated based on the relative beta*. And since I prefer to be a net delta buyer on balance, I can start with how many back-month futures I want to buy and then let that guide which delta call I sell.

A note on the vol charts above. Those are for USO which will trade in line with the near-dated futures options vols since that’s what the fund holds. However, USO liquidity is trash relative to the future options so I’d just trade the CME options via IB.

Unfortunately, I wasn’t able to build a delta-hedged structure as a package to trade on IB where I traded an option in a near-month vs a future in a back-month (you can do it if use the same month for the options and futures).

To execute you need to work the option order and as soon as it’s filled lift the Z25 futures leg.