Betting on PLTR to $40

Vertical spreads in action

Notable short seller Andrew Left’s firm Citron Research gave his “all roads lead to $40” pronouncement on X this week regarding PLTR 2.90%↑ :

Give Palantir the same $100 billion valuation that Databricks just earned. Where does that put the stock? $40. The exact same math we saw when comparing Palantir to OpenAI.

Tyler pinged me before the stock dove on 8/18 before the stock dove:

walk through of put spread LEAP payoffs on PLTR pls

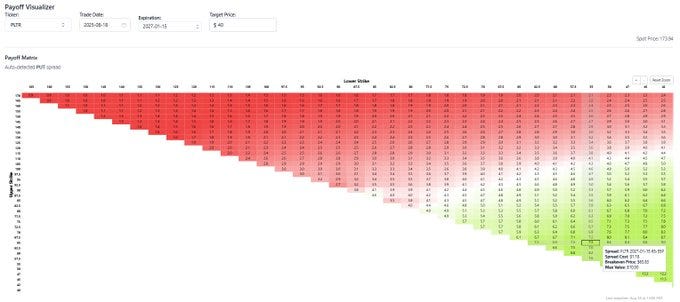

I pulled up moontower.ai to see what odds you can find to bet on $40:

Jan'27

67.5/50 put pays 8-1 if the stock hits 50 or lower ~11% chance of stock dropping 2/3

Tyler’s was drawn to a similar one before asking me:

my gut brought me to 65/55

I looked it up. That one is similar, pays 7.5-1

Put spreads, like any vertical spreads, are straightforward, risk-budgeted, ways to bet on an outcome by a specified expiration. Tyler followed a proper instinct — “Hey someone made a prediction, what odds are being offered by market prices?”

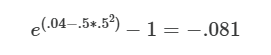

Since stocks obviously only go up in America, those odds don’t sound too exciting for something that is obviously impossible. But putting aside the laws of patriotic stock market anti-gravity, the mathematics of variance drag are the true reason why the odds feel underwhelming — PLTR is a high vol stock so a high likelihood of a negative return is baked into the surface:

In risk-neutral pricing world with RFR of 4% the median one-year outcome for a 50% vol name is RFR minus half the variance.

See Vol drag is misunderstood...until now

You can use my simulator to mess with this idea.

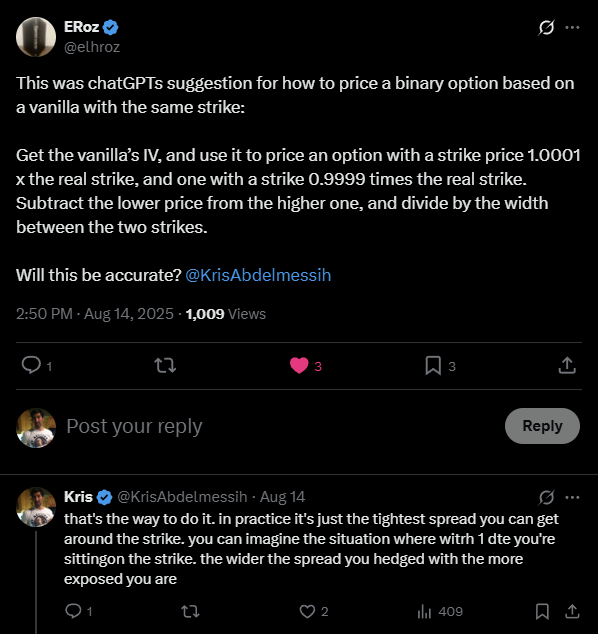

Another application of vertical spread: hedge binaries

Between ERoz and Tyler I feel like I’ve been the options candyman this week. Say my name and I appear. Except you don’t even have to do it 5x.

I gotta change that, I ain’t THAT thirsty.