A Visual Primer For Understanding Options

A visual mapping of the greeks

This is a guest post by @KeyPaganRush. You can find the origin of this collaboration here.

If you’re a normal civilian like me, who at the very most took vector calculus as an undergraduate, you’d probably look at a differential equation like this and have the following reaction:

It doesn’t help that most people in finance who work in the volatility space are mathematically adept and don’t necessarily know how to simplify this for mathematical muggles.

I’m not that great at mathematics myself and although I use statistics and probability on a regular basis for my non-finance day-job, most of this is stuff covered in the 2nd year of an undergraduate course.

Concepts become more intuitive when I can visualize them, which has helped me scrape together just enough mathematical literacy to be decent at my job. Applying the same thinking to options, I decided to give up on trying to interpret options from the standpoint of differential equations, and instead lean into my already existing intuition of probability and statistics.

Conveniently, both approaches get you to the same answer.

I expect this approach can help other civilians finally make sense of the vol space.

An intuitive understanding of options

Probability distributions

When looking at the price of a stock, there are only 3 results that can occur next: Go up, go down or stay flat. If we make a big assumption that the chances for each are all the same, you can simulate a price chart as just being a long series of up, downs or flats.

The Galton Board shows that repeating the simulation many times over, you will find that the final price of a stock (each ball) forms a bell-like distribution, the normal distribution. Even if the probability is not equal, this is a starting point to model price movements.

Option prices as segments of distributions

You might have heard that options represent the full distribution of the market and are thus the real underlying. Sure you can argue, in the literal sense, that they are not the underlying, but that viewpoint is useless for making money, where the underlying stock price is a blunt representation of what the market expects. To illustrate, think of a stock as having a probability of having an ending price, represented by the graph below.

The market probabilities assigned to each of these prices is influenced by the buying/selling supply/demand of options. The peak of the distribution is typically the ATM. When you buy a call option at strike K, you are paying for the probability (The shaded green area) on the right side of K.

Conversely when buying a put option you are paying for the probability on the left side of K. This area of probability you buy is what you pay for an option.

When you sell your call, whatever probability is still existing to the right side of K is your payoff. Larger area of probability = more expensive the option is. So what can influence how much this option will end up costing?

When long a call option, if the price of the stock goes up, this shifts the entire distribution to the right. Each time the distribution moves to the right, because the stock goes up in price, you are gaining more area of probability and thus increasing the price of the option.

Delta and Gamma

When playing around in your mind with these graphs, you can normalise the amount of area you have, as a ratio of the entire distribution.

The area that is moving past your strike, as a ratio of the entire distribution, is Delta¹.

Notice however, that the change in delta gets bigger as the price of the stock gets closer to your strike. It then begins to scale down as you get past your strike and start moving further away from your strike. This means your delta is changing as a function of price. This ratio between the change in delta and the change in price, is gamma.

Vega

The area of that call option can get bigger (more expensive) even if the price of the stock stays completely still. Notice that if we just make the distribution wider, you gain more area of probability to the right side of your strike. Remember that the height of distribution at each price is influenced solely by buying/selling of options, or IV. Thus just by the market increasing the width of the entire distribution, the option can become more expensive. This ratio between the increased area for each increase in the width of the distribution is Vega.

As a bonus, you will probably notice that as a result of increased IV, the ratio between the area of the distribution per change in price, has also changed. This is vanna.

Theta

As time passes, the width of the distribution gets thinner. Why?

Imagine a $10 stock moves on average $1 a day. What chances would you give it of getting past $20 if you checked on it 250 days from now?

What about if you only gave it 1 day to do so?

See how the chances drop dramatically when there isn’t much time left for the price to move around? Thus as time passes, the distribution to the right side of your strike is moving inwards towards the ATM, reducing the area to the left of your strike over time ( and thus reducing the price of your option). This is theta.

As a bonus, you will probably notice that as a result of passing time, the ratio between the area of the distribution per change in price, has also changed. This is charm.

Central moments

The price of a stock is really a representation of only one thing: where will the peak of the distribution go, left or right? In fancy speak, we say it is the first central moment of the distribution, otherwise known as the mean/average of the distribution. It is just one aspect of the distribution.

When you introduce the process of delta-hedging, (see my video Gamma and Vanna Exposures) you are trying to prevent your PnL from being influenced by the shifting of the entire distribution, Ie. changes in the price of underlying.

This temporarily “locks” your distribution in place, meaning that it can now only change in shape. Since the distribution cannot slide left or right, the only way the price of the option can change is for the shape of distribution to change.

So how can options become more expensive or cheaper now?

2nd Central Moment: Implied volatility

If implied volatility increases the distribution gets wider and the option becomes more expensive. This width of the distribution, in fancy speak, is the 2nd central moment, or the variance of the distribution. Volatility is just the square root of variance.

3rd central moment: Skew

We can get even fancier by thinking, the total variance of the distribution might not necessarily change, but that one side of the distribution will get wider but the other side gets thinner, that there will be a difference in the relative widths on either end (tail) of the distribution. This is achieved by going short vol on one side of the distribution and long vol on the other side of the distribution, delta neutral. The difference in relative areas of the tails on either side of the distribution is the 3rd central moment, or Skew.

4th central moment: Kurtosis

It is even possible to make a bet that mean, variance and skew don’t necessarily change, but instead bet that the width of the distribution might be thin at the middle, but wider near the ends. This is done being short vol near the middle of distribution and being long vol near the tails. The relative widths of the distribution near the middle vs the tails is the 4th central moment, which we call kurtosis.

By looking at the options market, we are able to gain a rich source of information and opportunities for expressing very specific views on what the market thinks the shape of the distribution is, that are independent of the entire distribution shifting left or right (Ie, price of the stock going up or down).

Appendix

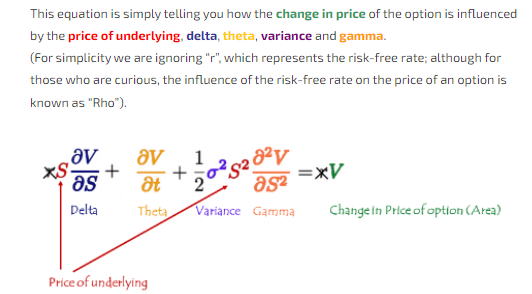

Coming full circle to the original differential equation, we can now break down the meaning of this.

Using some basic algebra, we can re-arrange the equation (Move the right-most terms to the left side of the equation) to read like this:

You may notice I did not highlight any vega term in the equation, to avoid getting too far into the weeds with the mathematics since Vega gets embedded inside the delta and gamma of the equation. This is because both are influenced by variance (The distribution getting wider). You can visualize this concept by changing the width of a distribution and observing how it affects delta and gamma.

Trying this out with some real numbers, lets see how this breaks down.

- Take a call option on a stock which is currently trading at 100.

- The strike is 110, with a 1 year expiration, interest rate at 0% and volatility of 10% annualized.

- This stock does not pay any dividends.

An option calculator yields:

Our fundamental equation in terms of Greeks can be used to relate the value of the option to the size of the stock move. If the move size is the same as the volatility used to price the option then we’d expect the p/l to be zero.

To see this we need to keep time units consistent. We transform annual parameters into daily ones.

- Convert annual volatility to daily volatility by dividing it by the square root of 365

- Annualized rates can be converted to a daily rate, simply by dividing by 365

Plug and chug:

The left and right hand sides of the equation equal each other!

Assuming a 0% risk-free rate, if an option were priced perfectly (ie volatility is perfectly forecasted), then any gain made from movements of the price of the underlying should be offset by the theta that is going to be bled off.

More practice

What happens if one day were to pass, but the underlying did not move at all?

The purple term representing the “change in stock” will be 0 rendering the “gamma p/l” for that day to be zero.

The option will be decay by its theta and there will be no offsetting gamma p/l. For that day, the option was “overpriced”.

What happens if after buying the option, realized volatility were to increase from 10% annualized to 15% annualized?

We capture a gamma p/l as follows:

In this case the gamma p/l of .0082 was greater than the theta of .0036 so the owner of the option has won. The option was “underpriced” for that day because the annualized move of 15% exceeded the 10% annualized volatility the option was priced with.

In daily terms, remember a 10% annual volatility corresponds to a 1-day change of .52% and a 15% annualized move corresponds to a 1-day change of .79%.

The readers is welcome to discover how the p/l is a non-linear function of the difference between the realized and implied move sizes (gamma attribution is a squared term!)

Summary Tables

Conclusion

Our original equation reinforces the idea that the Black Scholes Equation is a non-arbitrage condition stating that if volatility were perfectly priced the value of the option is equal to the cost of the replicating portfolio.

Takeaways

- Stocks only represent the first moment, a single point of the distribution but nothing about its shape or how it changes over time.

- Options will tell you about the entire shape of the distribution, which is why I submit that they are in a sense the true underlying distribution.

Further reading